Financial Modeling

-

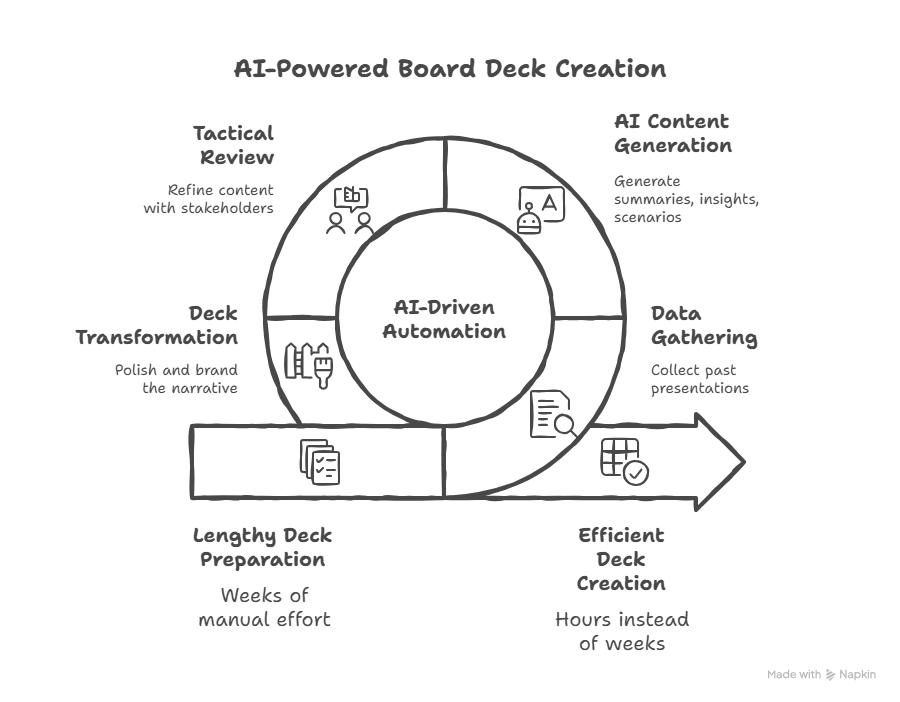

4 Hours to a Board Deck: How CFOs Are Using AI to Transform Financial Presentations

For CFOs, the quarterly board presentation represents a significant operational and strategic challenge. Board meetings require clear communication of key metrics such as cash position, revenue growth, and major investments. The process, which commences usually a few weeks before the close of a quarter, is typically characterized by an intensive, multi-week effort. It involves coordinating… Continue reading

-

LCV is for client unit economics, True Profitability is for product unit economics and another approach to drive value in your SaaS business.

Living in a SaaS world, we are often focused on LCV (Lifetime Customer Value) for a critical unit measurement of profitability. But, it’s also important to understand your product unit economics. True Profitability, a term and methodology developed by Pedro Ferro and described in his book by the same name, determines the specific unit economic… Continue reading

-

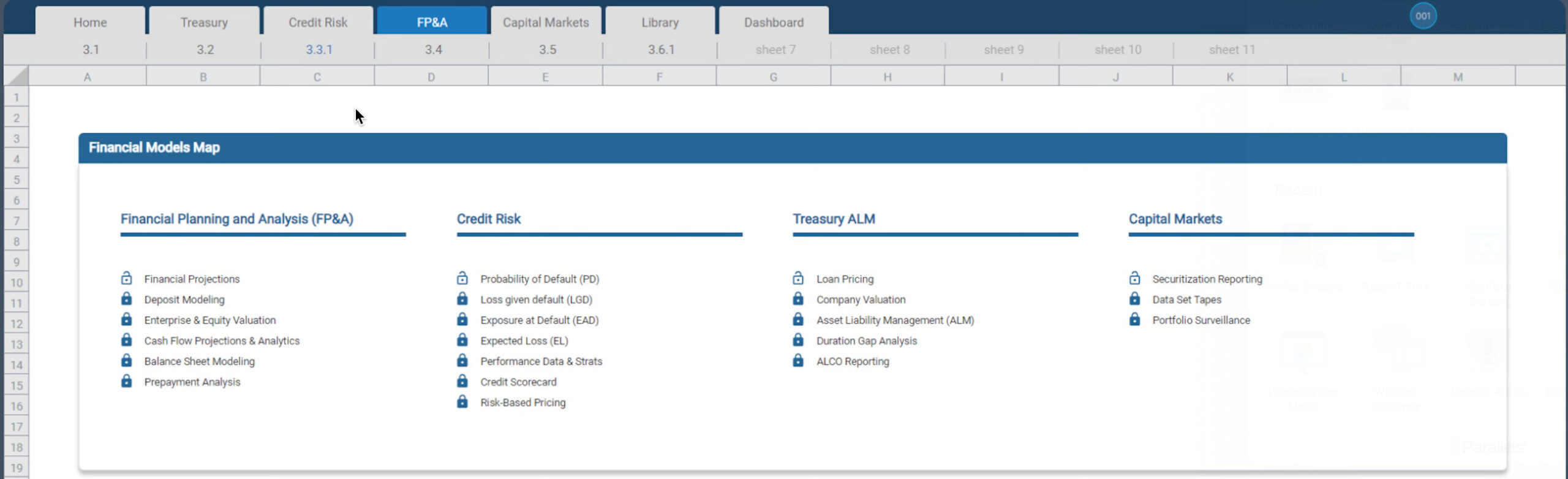

Managing a Loan Portfolio with Great Analytical Tools

Partnering with Vector ML Analytics, my team transformed our consumer loan portfolio’s financial reporting, emphasizing advanced analytics for precision and efficiency. This collaboration covered data integration and deployment, improving reporting through automation, resulting in speed, accuracy, cost savings, and better decision-making. Our enhanced reporting capabilities now include detailed asset and liability insights, weekly cash flow… Continue reading

-

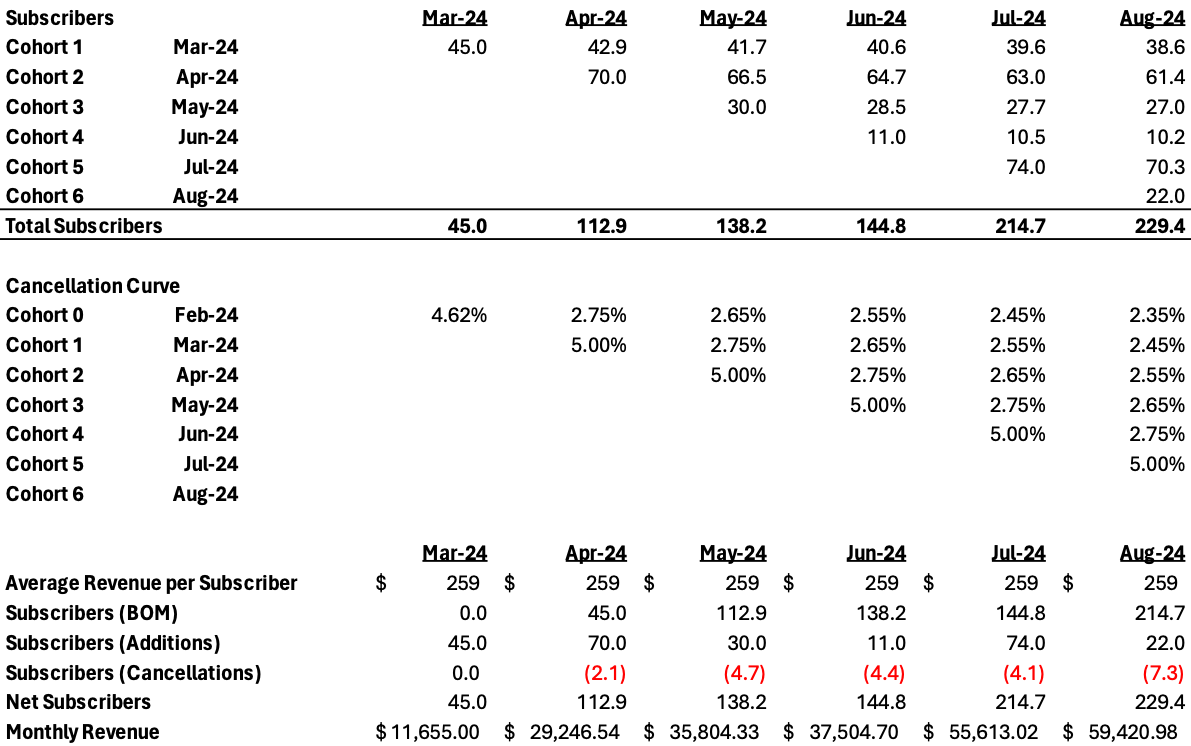

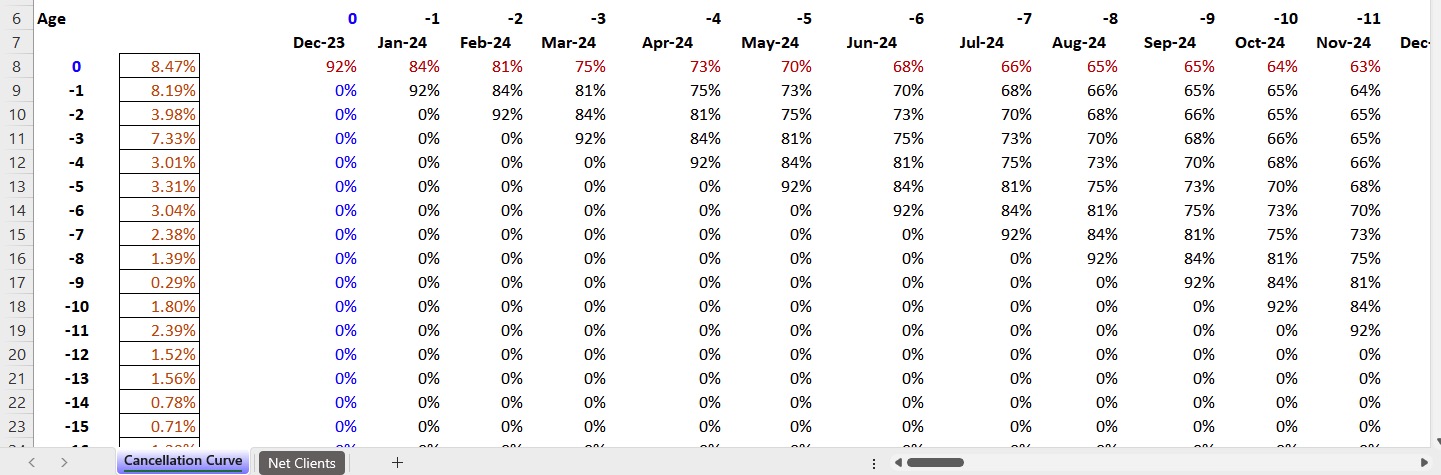

Recurring revenue modeling can be tricky, using cancellation curves can improve precision and results

In a recent post on SaaS financial modeling, I covered some of the main drivers that play a role in the construction of financial forecasts for SaaS and related business models. One of the most important aspects of such financial forecasts is the build out of contracted revenues. In general contracted revenues can be quite… Continue reading

-

Key considerations for SaaS (or any recurring revenue) financial models

Build your components so the are easily expandable in time and detail In SaaS, decoding revenue dynamics is pivotal for pushing the business forward. Let’s talk about the elements of financial modeling tailored for SaaS companies: 1. Revenue Insights: MRR (Monthly Recurring Revenue): This quantifies the predictable monthly revenue, offering immediate insights into short-term revenue… Continue reading

-

How We Replaced an Implementation of Workday Adaptive Enterprise Planning Management with Microsoft’s PowerBI Tailored for FP&A Reporting

Excel’s powerful capabilities, integrations and flexibility make it a favored tool for all financial and accounting professionals. Like many middle market companies, we considered moving from an Excel dominated financial planning and reporting process to an “enterprise grade” solution. A very difficult decision, we set aside Excel for a unified financial planning tool, also known… Continue reading