Build your components so the are easily expandable in time and detail

In SaaS, decoding revenue dynamics is pivotal for pushing the business forward. Let’s talk about the elements of financial modeling tailored for SaaS companies:

1. Revenue Insights:

MRR (Monthly Recurring Revenue): This quantifies the predictable monthly revenue, offering immediate insights into short-term revenue trends. In my experience, I build monthly forecasts and report on the business against the forecast monthly. Having a predictable MRR with less than 1% variance to the rolling 90-day forecast is achievable and ideal. (Of course, early in the business these variances could be higher.)

ARR (Annual Recurring Revenue): An annualized view of MRR, guiding long-term planning and providing a comprehensive overview of revenue trajectory. Often ARR is used to give investors a sense of how much revenue the business has on the books that will repeat for the following year. This gives comfort to investors who see this as a baseline of revenue helping fund the company. Personally, I think contracted backlog is a more interesting way to look at this same element of SaaS, but I will cover that another day.

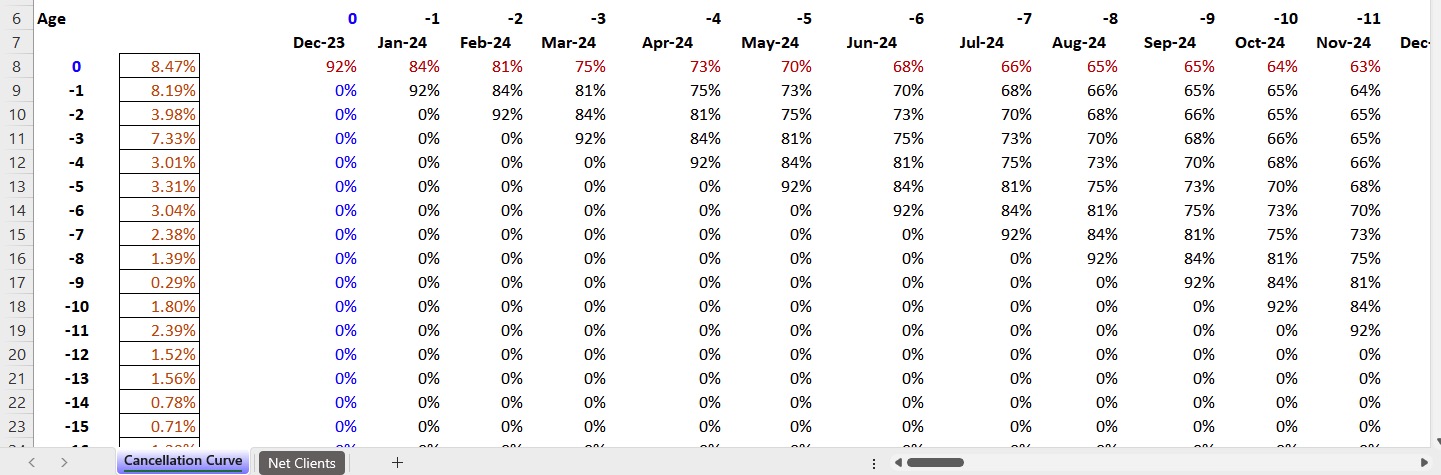

Churn Rate (aka cancellation rate): Measuring customer subscription cancellation, influencing MRR and ARR. Managing and reducing churn is crucial for cost-effective customer retention. Churn has two important modeling conventions that you should consider: first, does your cancellation rate change with the age of the client or contract. This is heavily influenced by the contract duration, but if you have no duration, this is an important factor to consider. Second, when modeling, it is often easier to model client counts as retention, which is (1-churn%). Always be sure that you are applying this correctly as there is a difference between churn-to-date and churn since the last period.

2. Cost Projections:

COGS (Cost of Goods Sold): Direct costs related to delivering the software service, impacting gross margin and signaling operational efficiency. Accurate forecasting is vital for profitability projections. Cloud services and direct IT support of software delivery and up-time fit into this bucket.

Operating Expenses: Day-to-day operational costs affecting operating margin and overall profitability. Monitoring ensures business efficiency and agility. This includes more typical overheads like rent, sales and marketing costs, R&D and management.

3. Customer-Centric Metrics:

CAC (Customer Acquisition Cost): Evaluating the average cost to acquire a customer. Discrepancies between CAC and customer LTV (Lifetime Value) indicate marketing or sales process inefficiencies. CAC should include all sales and marketing costs, including sales overhead for things like a CRM software, pre-sales scheduling and sales management. If you leave these items out, you are really looking at marketing acquisition cost. It’s useful in some cases to do this, but CAC, especially when you are running dynamic LTV analysis.

Retention Rate: Depending on how you want to use this, it could be a very granular financial model component. Otherwise, it can simply be the percentage of retained ARR over a specified period. The latter example again is an important metric to help convince investors you have a stable source of revenues.

LTV (Lifetime Value) aka LCV (Lifetime Customer Value): One basic approach is to calculate this as total gross profit from a customer throughout the lifecycle of the client. Personally, I like to be very granular with this and I use specific components of the above for the analysis: -CAC, +churn adjusted revenues, -churn adjusted COGS = LTV Contribution and -allocated overhead = Net LTV. In addition to the final LTV values, I look at the following ratios: LTV Contribution to CAC and LTV Net to CAC. Note: Churn adjusted revenues and expenses are very useful when you have client with changing cancellation rates over time. Pro tip: You can also look at this by subscription cohorts if you sign up a lot of contracts each month.

4. Financial Health Analysis:

Cash Flow: Tracking cash movement for informed management of working capital and expense management.

Break-Even Analysis: Predicting profitability by determining the sales volume needed to cover costs. Essential for strategic pricing and sales strategies. In this area, it’s useful to look at the count, value and consistency of new contract additions in the forecast to determine when the business becomes profitable.

Understanding these components offers a complete view of the current and future operation, empowering leaders to make informed decisions aligned with growth objectives. The interplay of revenue insights, cost projections, customer-centric metrics, and financial health analysis forms the bedrock for a robust SaaS financial model.

See my blog post on PowerBI for FP&A here.

FAQs about this blog post.

- Question: Why is Monthly Recurring Revenue (MRR) considered a vital metric for SaaS companies?

Answer: MRR quantifies predictable monthly revenue, providing immediate insights into short-term revenue trends. It is crucial because it helps in building monthly forecasts and tracking business performance against these forecasts, ensuring stability and growth. - Question: How does Customer Acquisition Cost (CAC) contribute to financial modeling for SaaS businesses?

Answer: CAC evaluates the average cost to acquire a customer and is essential for assessing marketing or sales process efficiencies. Including all sales and marketing costs, such as CRM software and pre-sales scheduling, ensures accurate financial modeling, especially when conducting dynamic Lifetime Value (LTV) analysis. - Question: What role does Churn Rate play in SaaS financial modeling, and how should it be interpreted?

Answer: Churn Rate, also known as cancellation rate, measures customer subscription cancellations, influencing both MRR and ARR. Understanding churn is crucial for cost-effective customer retention. When modeling churn, it’s important to consider if the cancellation rate changes with the age of the client or contract and ensure correct application to avoid discrepancies between churn-to-date and churn since the last period.

About me

Throughout my career, I’ve been dedicated to driving innovation and strategic growth as a CFO. My ability to leverage analytics and data science has been instrumental in shaping successful business strategies. Let’s connect on LinkedIn and explore how my Fractional CFO expertise can help drive your company’s success with CFO PRO+Analytics.

One response to “Key considerations for SaaS (or any recurring revenue) financial models”

[…] Key considerations for SaaS (or any recurring revenue) financial models […]