Using Vector ML Analytics to Drive Success in a Consumer Loan Portfolio

In the dynamic realm of consumer lending services, precision and efficiency in financial reporting serve as linchpins for gaining a strategic advantage. Managing a loan portfolio with great analytical tools is a key component to achieve precision and efficiency. Recognizing this imperative, my team embarked on a journey to enhance our financial reporting capabilities for our consumer loan portfolio. Aiming to stay ahead of the curve, we partnered with Vector ML Analytics, a software company specializing in consumer lending financial analytics. The capabilities they provided proved instrumental in reshaping our approach to financial reporting, with a particular focus on portfolio analytics, warehouse reporting, securitization reporting, and servicer reporting. In addition, through our partnership with Vector ML, we were able to take our cash flow forecasting down to the weekly level from a previous monthly forecast. This drove significant working capital efficiencies for our asset-backed warehouse utilization.

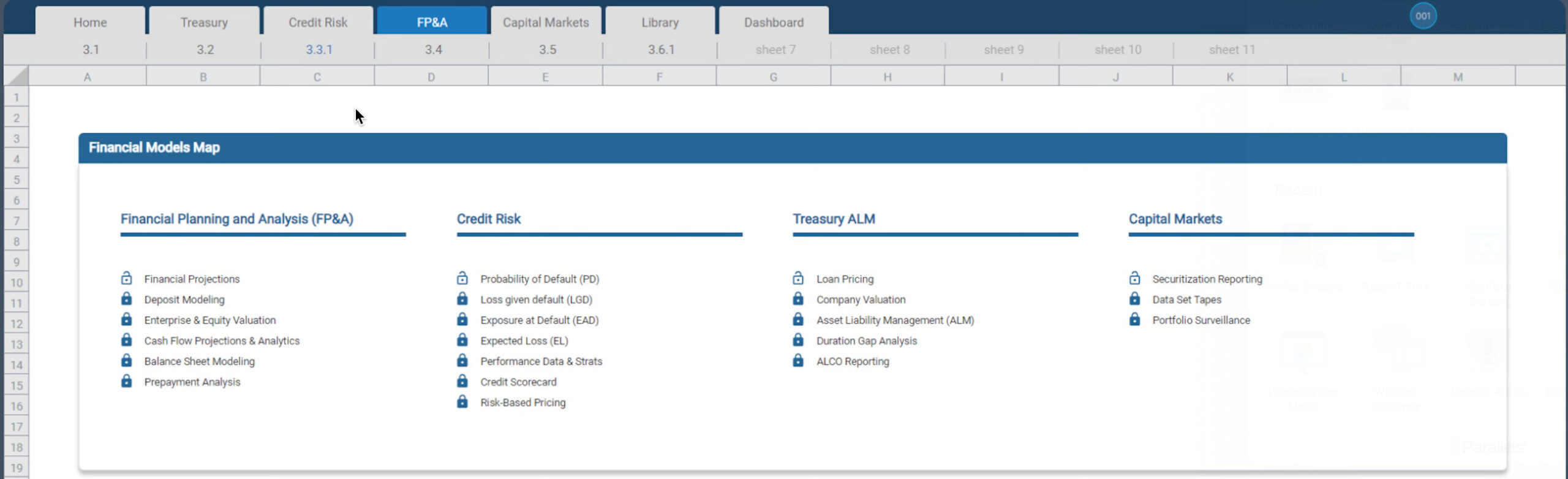

One great feature of Vector ML Analytics that we liked was the spreadsheet interface. This is a practice we have seen in generic FP&A tools, but it makes for a familiar work environment for all the analysts touching the system. The image below shows the main screen for Vector ML Analytics platform. You can see the spreadsheet interface in the background but in the foreground you see all the functional areas: FP&A, Credit Risk, Treasure and Capital Markets.

Phase 1: Data Mapping and Integration

Our collaboration with Vector ML Analytics commenced with a pivotal phase centered on data mapping and integration. Through close collaboration, our teams meticulously dissected and comprehended our existing reporting processes. This collaborative effort involved gathering and integrating crucial data and inputs into the Vector platform, including loan data tapes and assumptions essential for portfolio assets and liabilities. This foundational phase set the stage for a transformative overhaul, marked by frequent collaborative sessions and a comprehensive analysis of our prevailing methodologies.

Phase 2: Implementation and Deployment

With a thorough understanding of our unique requirements, Vector ML Analytics transitioned to the core phase of the project—implementation and deployment. This phase focused on customizing and configuring the Vector platform to not only replicate but also enhance our reporting processes. The emphasis was on leveraging automation to refine portfolio analytics, warehouse reporting, securitization, and servicer reporting. This customization aimed to integrate advanced analytics and automation, elevating our reporting capabilities beyond mere replication to empower strategic decision-making.

Enhanced Reporting Capabilities

Asset Reporting: A sophisticated cash flow engine was developed to forecast cash flows accurately under diverse scenarios, incorporating variables such as prepayments, delinquencies, and defaults. This capability provided us with deeper insights into our portfolio’s dynamics, facilitating more informed strategic decisions. Concentration risks are a key area for monitoring a consumer loan portfolio. Below you can see a geographic concentration dashboard by state.

Liability Reporting: Significant advancements were made in liability reporting through the automation and enhancement of warehouse borrowing base reports and monthly servicer reports. By optimizing eligibility and concentration limits and establishing customizable performance-related triggers, Vector ML Analytics provided us with a dynamic and responsive reporting framework, enhancing risk management and compliance.

ROI Enhancement through Improved Reporting:

The collaboration with Vector ML Analytics yielded tangible improvements in speed, accuracy, and overall efficiency, embodying the ethos of “better, faster, cheaper, smarter” financial analytics.

- 1. Speed and Efficiency Gains: Automation and bespoke features significantly accelerated our reporting processes, enhancing operational efficiency and reducing opportunity costs.

- 2. Accuracy and Precision: Advanced analytics and a robust cash flow engine heightened the precision of our financial reports, minimizing the risk of errors and providing a solid foundation for strategic planning and risk management.

- 3. Cost Reduction: Streamlined and automated reporting processes led to considerable cost savings, enabling more efficient resource allocation and enhancing overall cost-efficiency.

- 4. Smarter Decision-Making: Detailed insights empowered us to make more informed, data-driven decisions, facilitating strategic asset management and portfolio optimization.

Shocking the portfolio with different assumptions was a key requirement for us. This allows the portfolio manager to test different scenarios for risk and enable planning for adverse economic conditions outside of the company’s control. Below you can see the impact of three different scenarios on portfolio balance, actual interest income and amortization.

Summary

The synergy between our team and Vector ML Analytics underscores the transformative potential of technological innovation and specialized expertise in financial reporting. This partnership streamlined our reporting processes, provided critical insights for strategic decision-making, and significantly enhanced the ROI of our financial reporting endeavors. This case epitomizes the value of tailored financial analytics solutions in bolstering operational efficiency and strategic planning in the financial services sector.

Visit Vector ML Analytics here.

Visit my posting on survival regression for consumer credit risk here.

FAQs for Enhancing Financial Reporting in Consumer Lending Services:

1. How did the partnership with Vector ML Analytics enhance financial reporting capabilities for the consumer loan portfolio?The collaboration with Vector ML Analytics brought about significant enhancements in financial reporting capabilities by focusing on portfolio analytics, warehouse reporting, securitization reporting, and servicer reporting. Through advanced analytics and automation, the partnership enabled a shift towards weekly cash flow forecasting, driving working capital efficiencies and strategic advantages in asset-backed warehouse utilization.

2. What were the key phases involved in the transformation of financial reporting processes with Vector ML Analytics?The transformation journey with Vector ML Analytics comprised two pivotal phases:

- Phase 1: Data Mapping and Integration – This phase involved dissecting existing reporting processes, gathering crucial data inputs, and integrating them into the Vector platform to lay a solid foundation for the overhaul.

- Phase 2: Implementation and Deployment – Focused on customizing and configuring the Vector platform to enhance portfolio analytics, warehouse reporting, securitization, and servicer reporting through automation and advanced analytics.

3. What tangible benefits were realized through the collaboration with Vector ML Analytics in financial reporting?The partnership with Vector ML Analytics resulted in tangible improvements across various aspects:

- Speed and Efficiency Gains: Automation accelerated reporting processes, enhancing operational efficiency.

- Accuracy and Precision: Advanced analytics improved the precision of financial reports, minimizing errors for strategic planning and risk management.

- Cost Reduction: Streamlined processes led to cost savings, enabling efficient resource allocation.

- Smarter Decision-Making: Detailed insights empowered data-driven decisions for strategic asset management and portfolio optimization, embodying the ethos of “better, faster, cheaper, smarter” financial analytics.

About me

Throughout my career as a CFO, I’ve been committed to driving growth and innovation through strategic financial leadership. My expertise in analytics and data science enables me to deliver actionable insights that drive performance and maximize shareholder value. Connect with me on LinkedIn to discuss how my Fractional CFO expertise can elevate your company’s financial performance with CFO PRO+Analytics.