Salvatore Tirabassi

-

TikTok vs Meta Are A Worthy Comparison of AI Advertising Platforms

In the ever-evolving landscape of digital advertising, TikTok vs Meta platforms are a worthy comparison of AI Advertising Platforms. Meta’s Advantage+ advertising platform stands out as a prime example of this trend, offering automated solutions that leverage machine learning to optimize ad performance. TikTok has been evolving its strategy for over 2 years and now… Continue reading

-

The Convergence of Excel and Power BI

I eagerly await each new step in the convergence of Excel and PowerBI. More efficiency and productivity are the gains I foresee as a result. As some of you know, I have designed and built full PowerBI systems with the requisite personnel to create a true business intelligence consulting service inside organizations. It goes without… Continue reading

-

PowerQuery can Elevate QuickBooks Analysis in Excel

For those of you that know me, I am an efficiency seeker and delegator in the best (worst) possible way. I want processes that are repeatable and easy to understand. PowerQuery can elevate QuickBooks Analysis in Excel by streamlining QuickBooks reports that are not Excel Table friendly. This kind of data manipulation has become crucial… Continue reading

-

SAAS Revenue KPI Alignment: Creating Compelling Financial Narratives, A Fractional CFO Perspective

In the dynamic landscape of SaaS business growth, SAAS Revenue KPI alignment and the resulting ability to present a clear and compelling financial narrative to potential investors is paramount. This narrative is underpinned by the strategic alignment of key revenue growth, customer retention and customer acquisition cost KPIs, which serve as indicators of the company’s… Continue reading

-

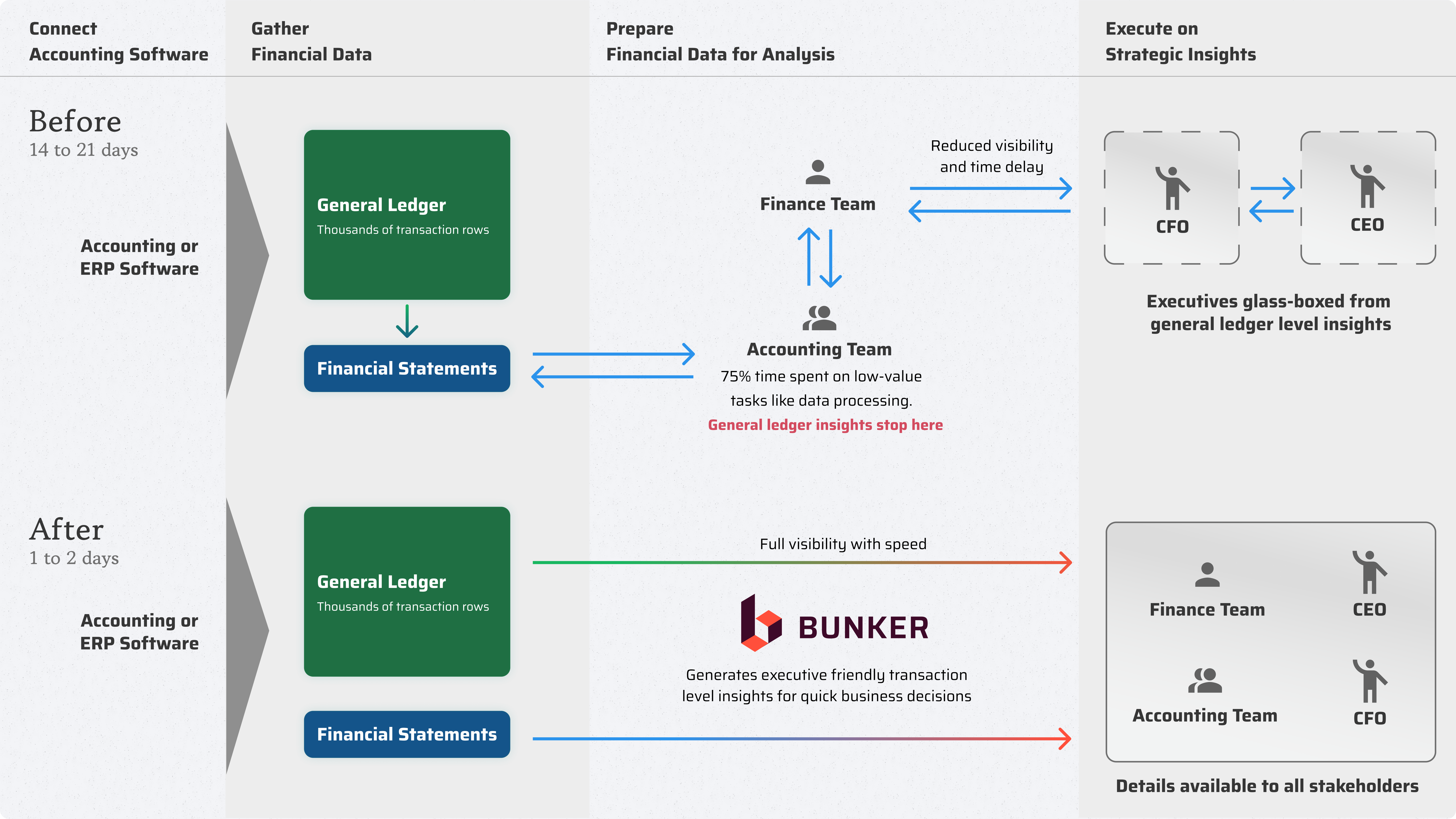

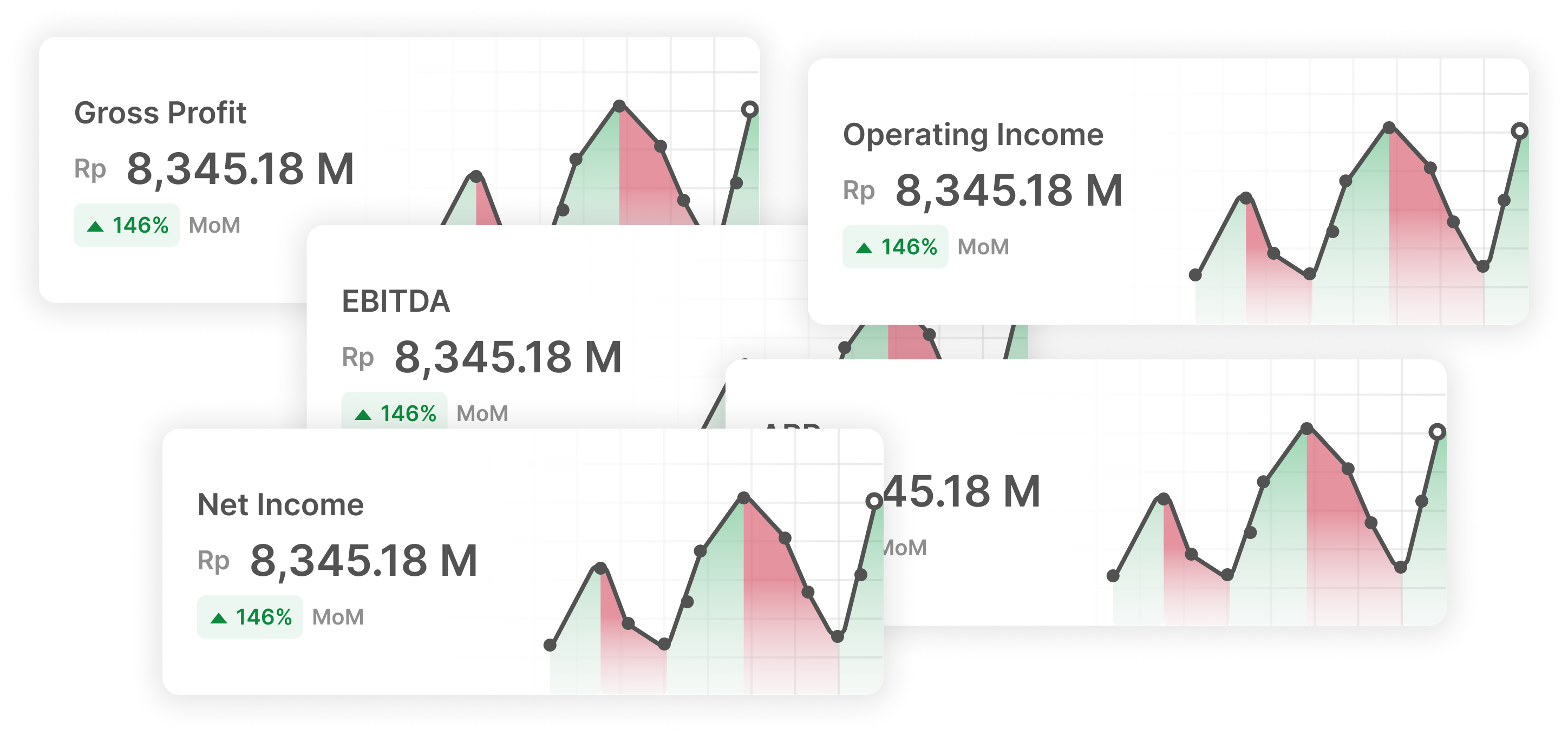

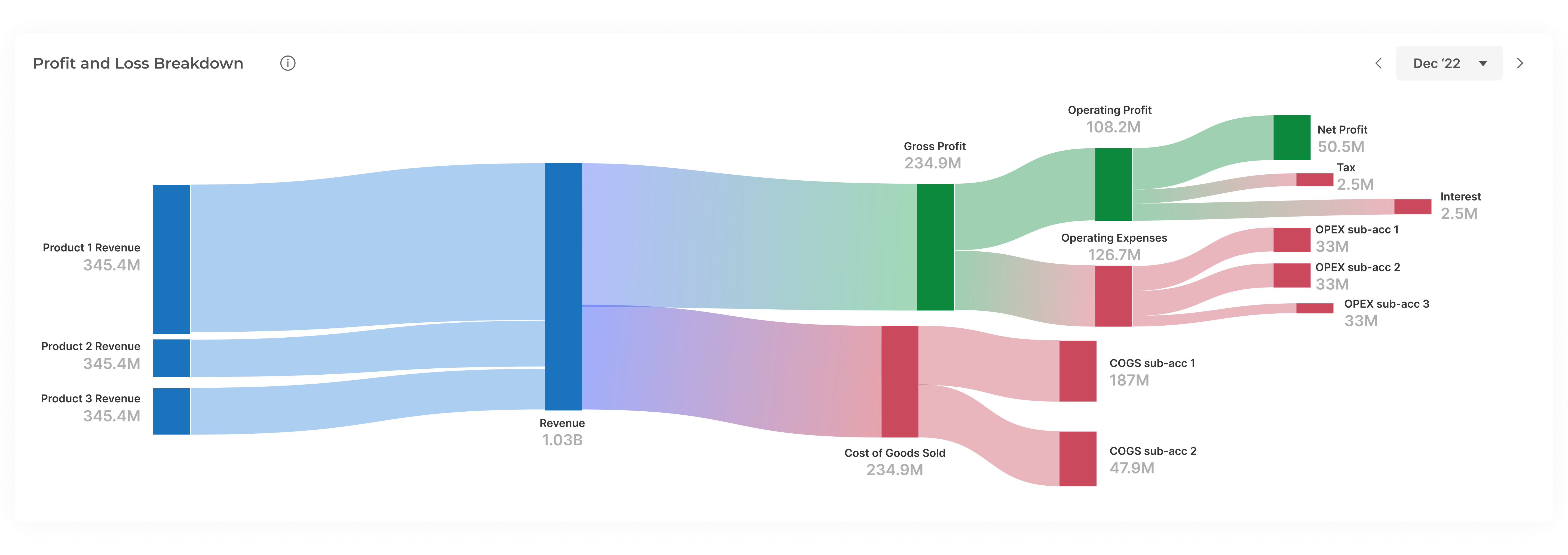

Tools for a Fractional CFO, Bunker vs. Reach Reporting for FP&A and Accounting

This year, I launched a Fractional CFO Services business. As part of my effort to steam line the financial reporting at my clients, I started using a software platform called Bunker, an innovative software company that provides great software for a Fractional CFO driving FP&A reporting, among other things. In order to settle on Bunker,… Continue reading

-

Wondering about machine learning in your efforts? Let’s talk the basics about Random Forest and XGBoost.

The business generalist or expert in a specific aspect of business operations might wonder about machine learning and data science. Random Forest and XGBoost are two techniques that are related and commonly used in business predictive modeling. I want to give you some basics for these frequently used techniques so you can be sharp enough… Continue reading

-

LCV is for client unit economics, True Profitability is for product unit economics and another approach to drive value in your SaaS business.

Living in a SaaS world, we are often focused on LCV (Lifetime Customer Value) for a critical unit measurement of profitability. But, it’s also important to understand your product unit economics. True Profitability, a term and methodology developed by Pedro Ferro and described in his book by the same name, determines the specific unit economic… Continue reading

-

Managing a Loan Portfolio with Great Analytical Tools

Partnering with Vector ML Analytics, my team transformed our consumer loan portfolio’s financial reporting, emphasizing advanced analytics for precision and efficiency. This collaboration covered data integration and deployment, improving reporting through automation, resulting in speed, accuracy, cost savings, and better decision-making. Our enhanced reporting capabilities now include detailed asset and liability insights, weekly cash flow… Continue reading

-

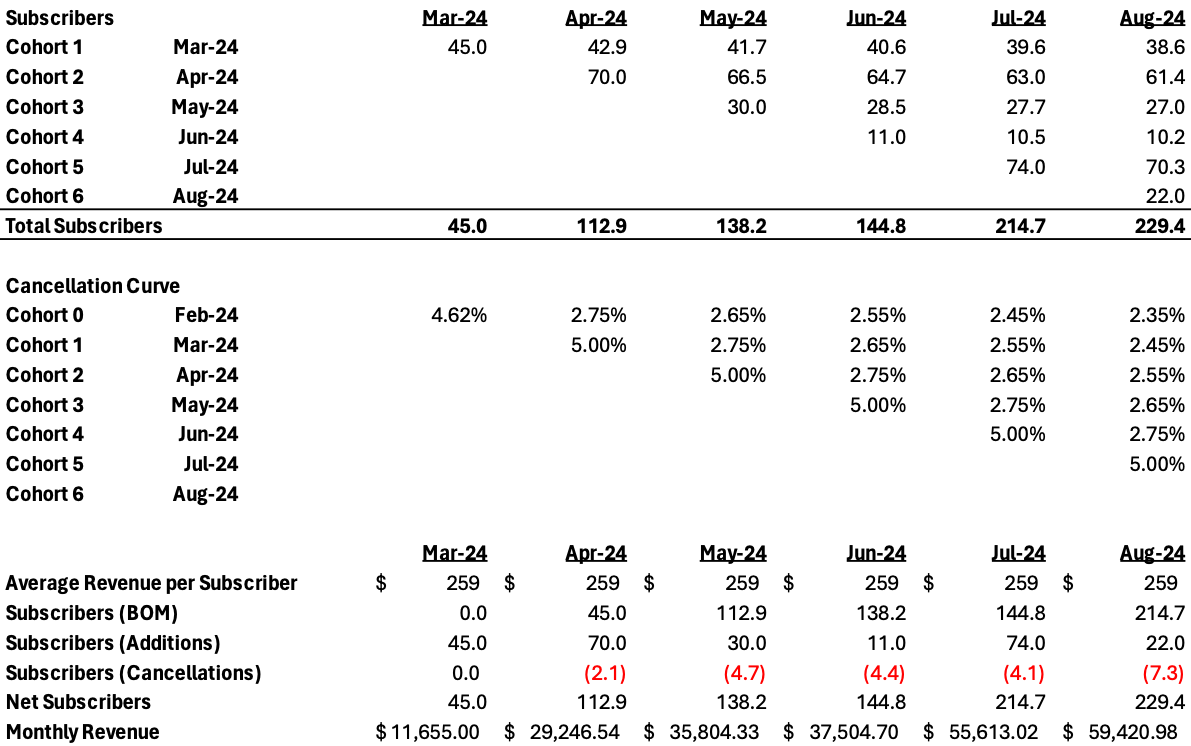

Recurring revenue modeling can be tricky, using cancellation curves can improve precision and results

In a recent post on SaaS financial modeling, I covered some of the main drivers that play a role in the construction of financial forecasts for SaaS and related business models. One of the most important aspects of such financial forecasts is the build out of contracted revenues. In general contracted revenues can be quite… Continue reading