You might see it in various places as CLV (Customer Lifetime Value) or LTV (Lifetime Value). Lifetime Customer Value, or LCV, is what I call this metric. Fairly interchangeable in my experience, people who use these metrics regularly will know what you mean when you refer to any one of them. LCV’s compact measurement of the value of an individual customer unit is powerful. It’s something that I have been using for years and would like to share some insights into it.

Conceptually, LCV can be calculated as the net value of a customer over their lifetime. In theory, if you calculate it to a net value including allocated overhead costs for every single customer and then summed all of those individual values up, you should be very close or equal to the enterprise value of a business calculated in a discounted cash flow. These two things (Sum of LCV and DCF EV) equate because the LCV is basically taking the net present value of each individual customer’s cash flow, and when summed up, it should equal the net present value of the company’s cash flow. As mentioned, this assumes you calculate LCV on a net basis with accurate allocation of overheads.

If you look at it from the other direction, you could say that LCV equals EV divided by all active customers. Cable television companies often use (at least I think they still do) the EV divided by active customers to derive a value per subscriber metric for valuation purposes. This is a very easy way to examine the relative strength of the individual subscribers across companies by comparing the relative value per subscriber between companies.

The importance of these equalities is that LCV, as an operational metric usable in all areas of the organization, is tied to value creation for the entire business. If marketing pushes Customer Acquisition Cost (CAC) down, then LCV goes up, and the business should gain value. If the cost of goods sold goes up, then LCV goes down, and so does the value of the business. If an organization embraces this metric, they can push shareholder value creation alignment into many corners of a company.

When it comes to LCV, one of the main areas of focus in most cases, I find, is CAC. CAC can be volatile, especially in a world of digital marketing, where competitive forces can turn against you and make marketing very expensive in short and even sustained periods of time. As a result, if you have sticky pricing and overall operating expenses over the course of a year, CAC tends to be the part of LCV that causes the most fluctuation.

When it comes to marketing, CAC does this in two main ways. The marketing expense can fluctuate in or out of your favor, which drives LCV up or down. But given that marketing fluctuations can also translate into higher or lower customer acquisition counts, the LCV can compound its impact on the overall valuation – the sum of the LCVs as described above.

The two-by-two below illustrates the concept at a very high level.

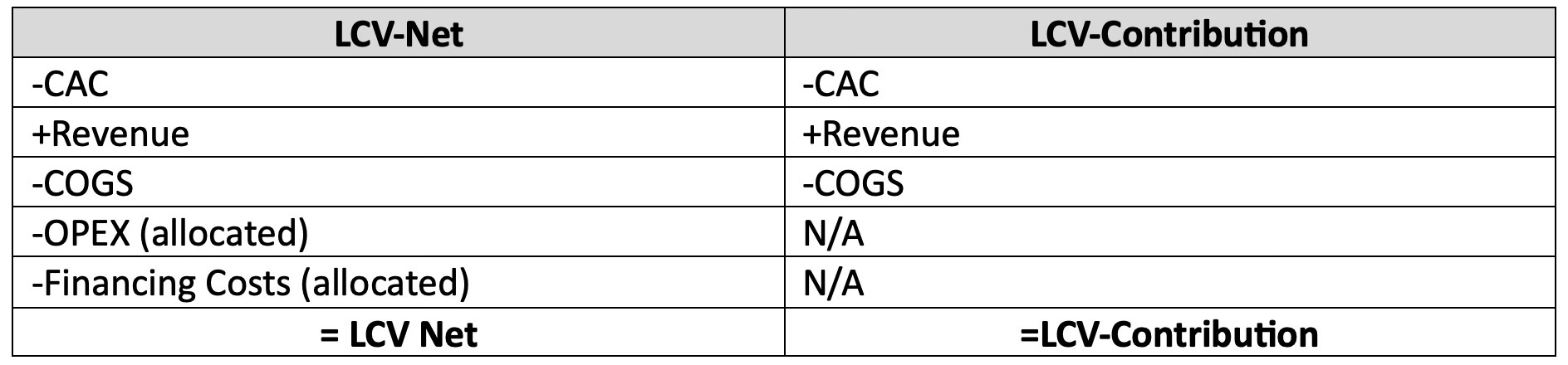

Another area of interest is LCV as a contribution calculation before overhead versus LCV as a net calculation after overhead. The table below shows the differences between the two calculations at a high level.

I already touched on the net calculation and how it is connected to EV. The contribution calculation gives you LCV down to the contribution margin level, which is to say LCV-Contribution is the lifetime customer value that can be used to pay all overhead and financing costs of the company. This is particularly useful if the organization has steady overhead costs that don’t increase quickly with the customer base.

It gives the business operators a sense of how many customers they can add to the business on a marginal basis profitably. It allows the operators to take aggressive approaches to CAC and Cost of Goods/Services because every customer with some value at the contribution level will drive growth in EV. With that said, such an approach would lower net LCV over time as lower contribution clients would dilute the average LCV.

To sum it up, Lifetime Customer Value (LCV) is a powerful tool that goes beyond just numbers. It tells us the long-term value of each customer and how it connects to the overall value of a business. By paying attention to LCV, companies can make smart decisions that impact everything from marketing costs to the value of the entire business. In the fast-paced world of digital marketing, where things can change quickly, understanding and using LCV gives businesses a reliable way to plan for the future.

The simple matrix and the difference between net and contribution calculations show how flexible and useful LCV can be. So, as businesses delve into LCV insights, they can uncover new ways to improve their strategies, build better relationships with customers, and set the stage for lasting success.

See my blog post on lifetime customer value here.

FAQs about this Blog Post

- What is Lifetime Customer Value (LCV), and how does it differ from other similar metrics like CLV and LTV?

Lifetime Customer Value, or LCV, represents the net value of a customer over their lifetime with a business. While it may be referred to interchangeably as Customer Lifetime Value (CLV) or Lifetime Value (LTV), LCV offers a compact measurement of individual customer value. Conceptually, LCV aligns with the enterprise value (EV) of a business calculated through discounted cash flow (DCF) analysis, assuming accurate allocation of overhead costs. This alignment signifies that LCV essentially captures the net present value of each customer’s cash flow, reflecting the overall value of the company. - How does LCV relate to shareholder value creation and operational alignment within a company?

LCV serves as a critical operational metric that influences value creation across various aspects of a business. For instance, if the marketing team successfully reduces Customer Acquisition Cost (CAC), LCV increases, leading to enhanced shareholder value. Conversely, an increase in the cost of goods sold would decrease LCV and diminish the business’s overall value. By embracing LCV, organizations can foster alignment in shareholder value creation throughout different departments. - What are the key considerations when analyzing LCV, particularly regarding fluctuations in Customer Acquisition Cost (CAC) and overhead expenses?

CAC plays a significant role in determining LCV, especially in dynamic environments like digital marketing, where competitive pressures can affect marketing expenses unpredictably. Fluctuations in CAC not only impact LCV directly but also influence customer acquisition counts, consequently affecting the overall valuation of the business. Moreover, there’s a distinction between LCV calculated as a net value after overhead and LCV as a contribution value before overhead. The latter provides insight into the lifetime customer value available to cover all overhead and financing costs, offering operators guidance on sustainable customer growth strategies. However, aggressive approaches to CAC and cost management may lower net LCV over time, highlighting the trade-offs involved in maximizing customer value.

About me

Throughout my career as a CFO, I’ve been committed to driving growth and innovation through strategic financial leadership. My expertise in analytics and data science enables me to deliver actionable insights that drive performance and maximize shareholder value. Connect with me on LinkedIn to discuss how my Fractional CFO expertise can elevate your company’s financial performance with CFO PRO+Analytics.

One response to “Unlocking Value Creation: The Power of Lifetime Customer Value in Operational Execution”

[…] Unlocking Value Creation: The Power of Lifetime Customer Value in Operational Execution […]