Finance

-

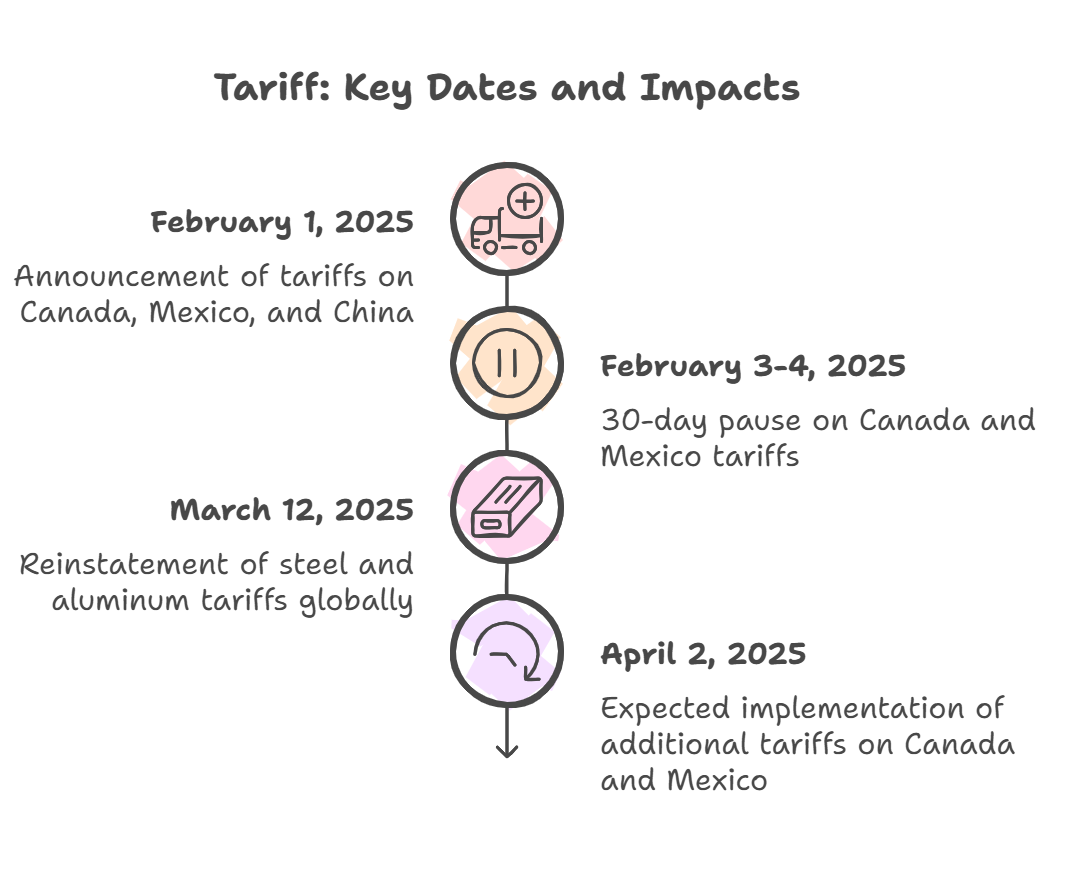

Tariff Impact: Beyond Headlines to the P&L Reality for Emerging Businesses

Overview The ping-ponging news on tariffs has been very confusing for emerging businesses and clients that I service through my CFO services practice. The international trade commission has found that while steel and aluminum producers may benefit from tariffs imposed by President Trump, the overall economic repercussions could be detrimental, particularly for downstream industries. In… Continue reading

-

Navigating ASC 606 in the SaaS World: Strategies for MRR and ARR Recognition

I recently implemented an ASC 606 system in an emerging company that needed to move from cash revenue accounting to accrual revenue accounting. Emerging businesses face this issue when they start raising capital and external parties and investors want to see audits. This whole process gets particularly tricky in situations where there is no contracted… Continue reading

-

Revolutionizing Consumer Loan Financial Reporting and Analysis

This blog discusses in more detail revolutionizing consumer loan financial reporting and analysis with Vector ML Analytics. A few weeks ago, I posted about my successful collaboration with Vector ML Analytics to enhance the financial reporting systems I used in a consumer lending portfolio. This collaboration involved a comprehensive corporate financial analysis to evaluate the… Continue reading

-

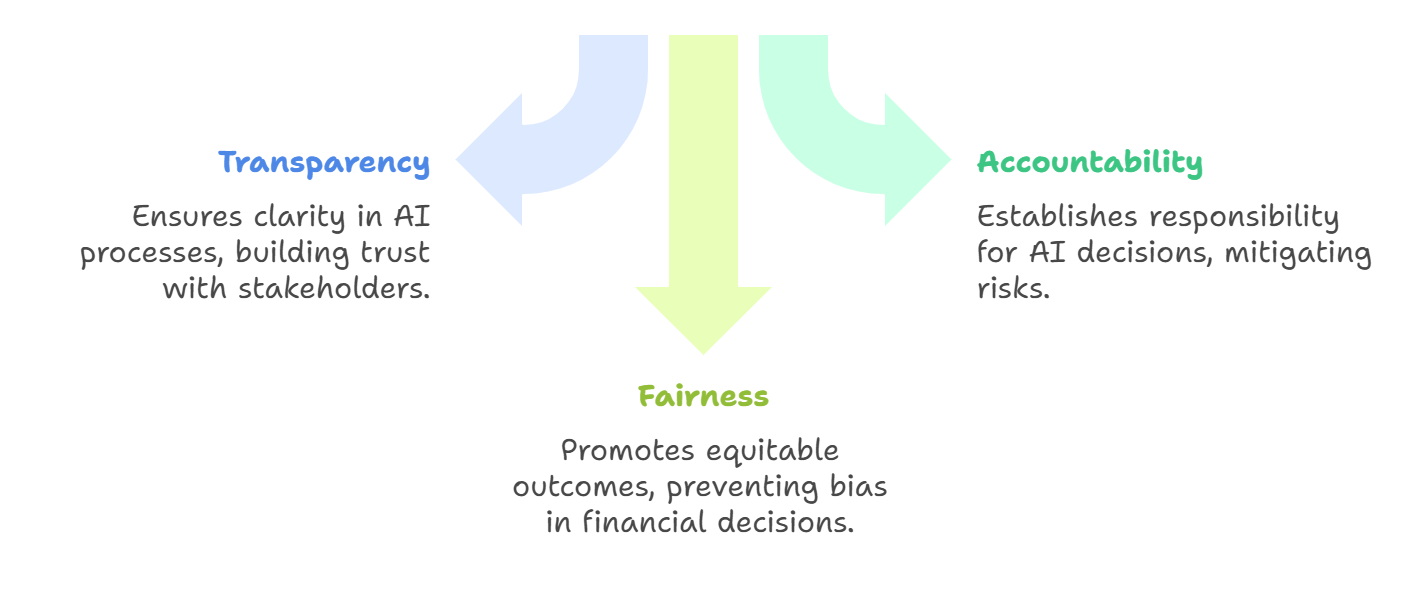

The CFO’s Guide to AI Ethics: Navigating the Black Box Problem in Financial Decision-Making

As a fractional CFO working across multiple organizations, I’ve observed a growing concern in the financial sector: the ethical implications of AI-driven decision-making. The “black box” nature of AI systems – where the input and output path isn’t clearly understood. This presents particular challenges in finance, where transparency and accountability are paramount. Here’s my perspective… Continue reading

-

The Hidden Truth About AI in Finance: Why Process Automation Must Come Before AI Implementation

As a fractional CFO working with multiple organizations across different industries, I’ve witnessed first hand a common misconception plaguing financial leaders: the belief that they can leap directly into artificial intelligence (AI) without laying the proper groundwork. While the allure of AI’s transformative potential is undeniable, there’s a crucial truth that many organizations overlook –… Continue reading

-

Payment Processing Optimization: How to Leverage Software to Maximize Revenue

In my years as a fractional CFO, I’ve watched promising companies hit a wall. It typically happens around the $5M ARR mark – the payment infrastructure that seemed robust at startup begins buckling under the weight of scale. The symptoms are similar: finance teams drowning in reconciliation, revenue leaking through failed payments, and customer churn… Continue reading

-

Bridging the Gap: How Fractional CFOs Can Help Microcaps with Their Unique Challenges

Fractional CFO can help microcaps with their unique challenges using many of the same techniques applicable to private companies. A little bit of a tangent this week from financial analytics topics and a dive into the practicalities of CFO work and how it integrates into investor relations and value creation. I’ve worked with private companies… Continue reading

-

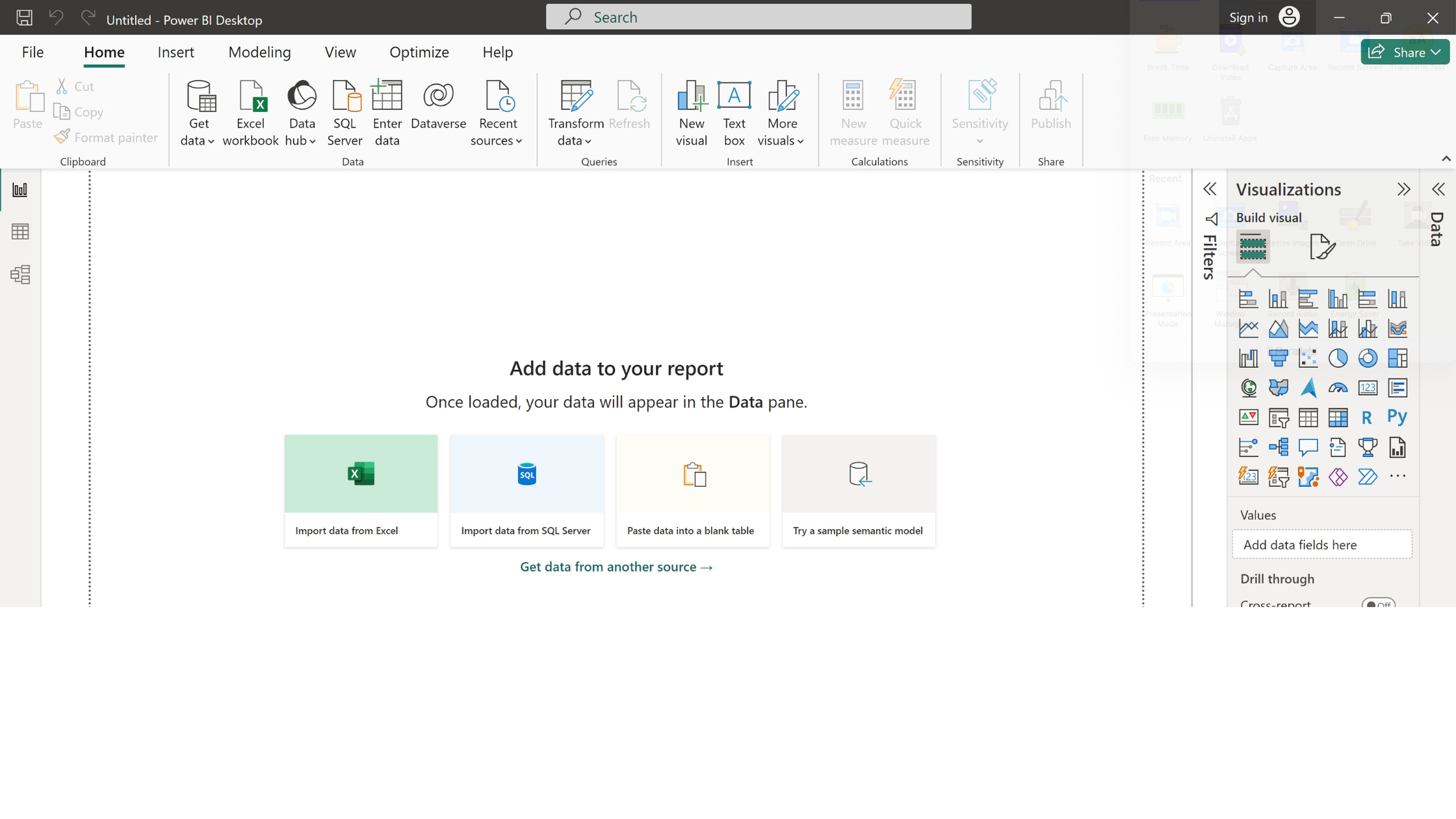

The Convergence of Excel and Power BI

I eagerly await each new step in the convergence of Excel and PowerBI. More efficiency and productivity are the gains I foresee as a result. As some of you know, I have designed and built full PowerBI systems with the requisite personnel to create a true business intelligence consulting service inside organizations. It goes without… Continue reading

-

PowerQuery can Elevate QuickBooks Analysis in Excel

For those of you that know me, I am an efficiency seeker and delegator in the best (worst) possible way. I want processes that are repeatable and easy to understand. PowerQuery can elevate QuickBooks Analysis in Excel by streamlining QuickBooks reports that are not Excel Table friendly. This kind of data manipulation has become crucial… Continue reading

-

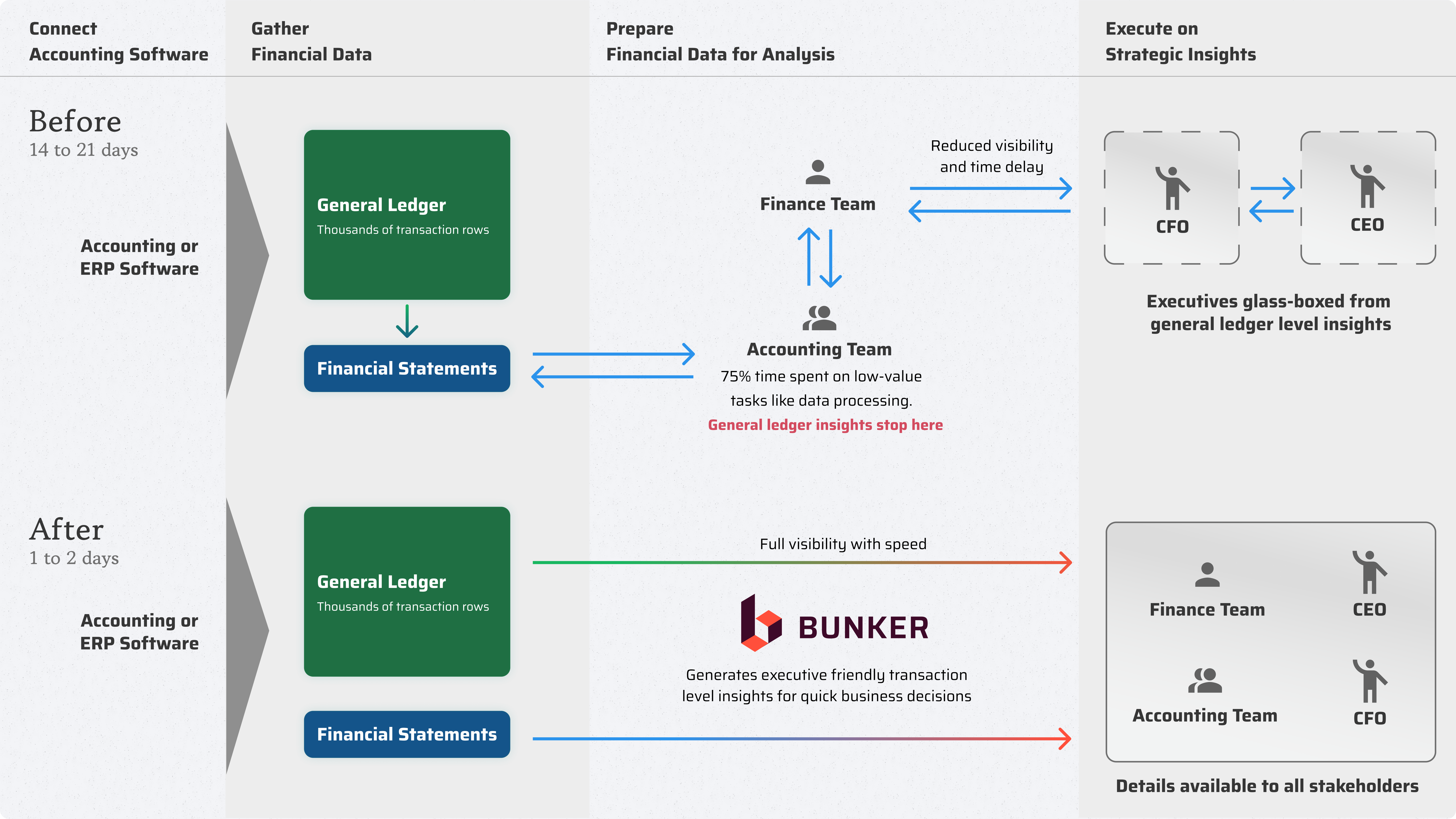

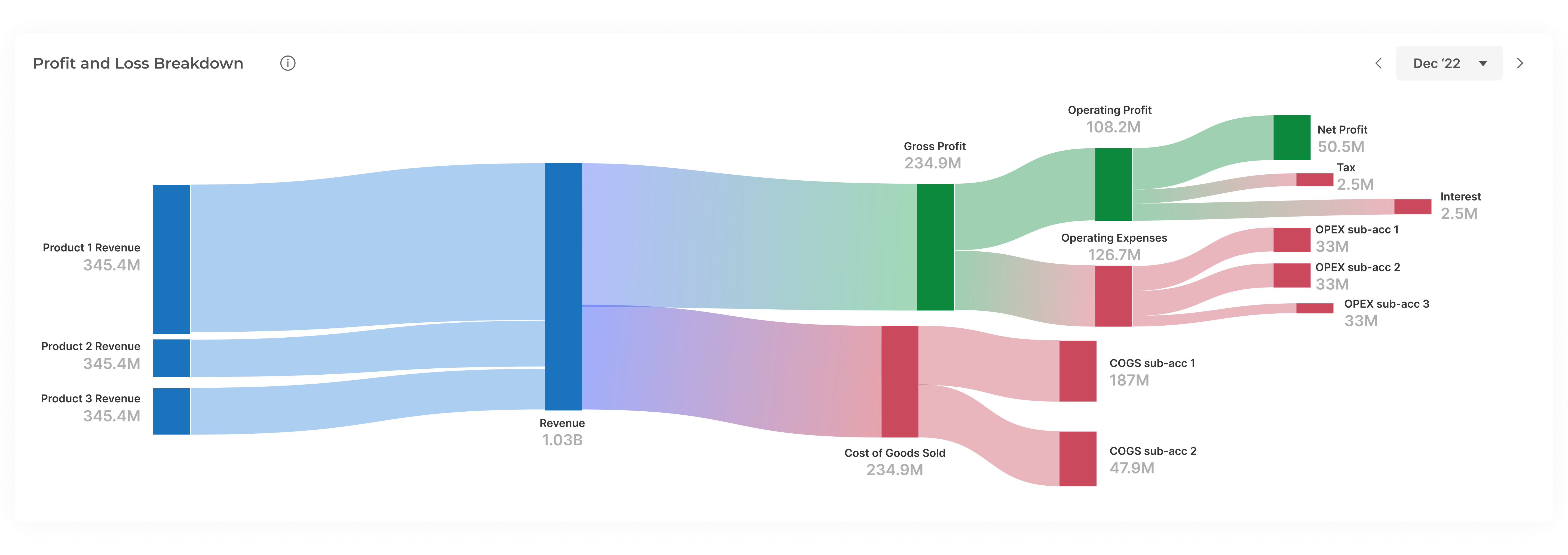

Tools for a Fractional CFO, Bunker vs. Reach Reporting for FP&A and Accounting

This year, I launched a Fractional CFO Services business. As part of my effort to streamline the financial reporting at my clients, I started using a software platform called Bunker, an innovative software company that provides great software for a Fractional CFO driving FP&A reporting, among other things. Bunker is specifically designed for fractional CFOs… Continue reading