In the evolving landscape of consumer lending, fintech companies have revolutionized borrower experiences, introducing real-time approvals and swift fund transfers. While tree-based classification models like XGBoost currently dominate credit scoring, survival regression algorithms are an intriguing alternative.

(Quick note: These survival algorithms extend beyond consumer credit to products with recurring payments, such as subscriptions or memberships.)

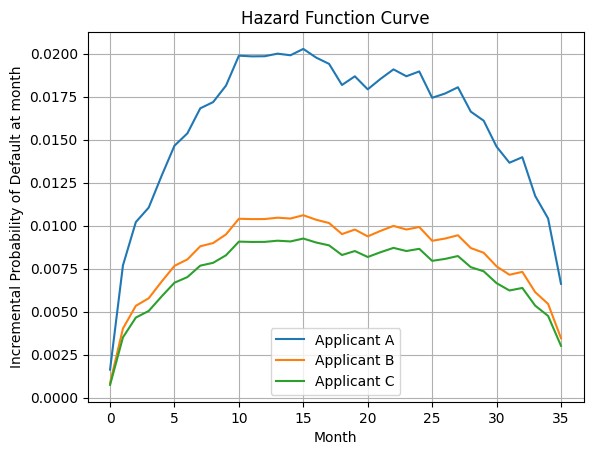

Traditionally applied in healthcare analyses, survival regression models predict the time until an event, with the “event” here signifying a potential default on a loan payment. Unlike traditional risk categorization, this model evaluates the probability of default for each payment, giving rise to a series of default probabilities known as the “hazard function curve.”

Essentially, the model provides the likelihood that a payment (be it a loan installment, gym membership fee, subscription, etc.) won’t occur as planned.

This approach deviates from static pricing for risk buckets, offering dynamic loan pricing that considers variations in risk among borrowers. Instead of assigning a risk rating and fixed price, the model calculates probability-adjusted cash flow for each payment, which aligns with fixed income cash flows.

The Cox Proportional Hazards algorithm anchors the model. Trained on historical loan data and inspired by academic research on credit risk pricing, it evaluates real-time default curves for prospective borrowers based on financial attributes.

The figures below illustrate three applicants (A, B, and C) using cumulative hazard and survival functions. A higher forecasted cumulative hazard curve implies a lower ending survival probability for the applicant.

The loan origination process involves financial analysis and interest rate application, constructing risk-weighted cash flow series. The targeted Net Present Value considers all costs, providing a comprehensive view of profitability.

The two figures display the same three applicants: A, B and C, in two ways, using the cumulative hazard function and the survival function. The higher the forecasted cumulative hazard curve throughout the months, the lower the ending survival probability of the applicant. Hazard and survival curves visually represent the model‘s approach for a 36-month installment loan with three applicants. Survival regression algorithms redefine consumer loan pricing, introducing precision and adaptability to risk assessment. Feel free to challenge conventional methods with this groundbreaking model!

See my posting on Algorithmic Crypto Trading.

See my posting on Operations Research and Data Science.

FAQs about this Blog Post

- How do survival regression algorithms differ from traditional credit scoring models like XGBoost? Survival regression algorithms, traditionally used in healthcare analyses, predict the time until a specific event occurs, such as defaulting on a loan payment. Unlike traditional risk categorization, which assigns a risk rating and fixed price, survival regression models evaluate the probability of default for each payment, providing dynamic loan pricing that considers variations in risk among borrowers. This approach offers probability-adjusted cash flow for each payment, aligning with fixed income cash flows, and is anchored by the Cox Proportional Hazards algorithm.

- What is the significance of the hazard function curve in survival regression models? The hazard function curve in survival regression models represents the likelihood that a payment, such as a loan installment or subscription fee, won’t occur as planned. It provides insights into the probability of default for each payment and allows for the evaluation of real-time default curves for prospective borrowers based on their financial attributes.

- How do survival regression algorithms redefine consumer loan pricing? Survival regression algorithms introduce precision and adaptability to risk assessment by providing dynamic loan pricing based on the probability of default for each payment. Instead of static pricing for risk buckets, these models calculate probability-adjusted cash flow for each payment, allowing for more accurate assessment of borrower risk and profitability. This groundbreaking approach challenges conventional methods and offers a more tailored and informed approach to lending.

About me

Throughout my career as a CFO, I’ve been committed to driving growth and innovation through strategic financial leadership. My expertise in analytics and data science enables me to deliver actionable insights that drive performance and maximize shareholder value. Connect with me on LinkedIn to discuss how my Fractional CFO expertise can elevate your company’s financial performance with CFO PRO+Analytics.