For CFOs, the quarterly board presentation represents a significant operational and strategic challenge. Board meetings require clear communication of key metrics such as cash position, revenue growth, and major investments. The process, which commences usually a few weeks before the close of a quarter, is typically characterized by an intensive, multi-week effort. It involves coordinating multiple team members—from analysts crunching data to controllers finalizing adjustments—often consuming over 40 collective hours. The CFO’s own time is frequently diverted from high-level strategy to the meticulous tasks of data validation, narrative construction, and slide formatting.

The outcome of this traditional process is often suboptimal: a presentation dense with data but lacking a compelling strategic narrative. When financial results are presented as a series of formatted spreadsheets, the core insights—such as cash position, revenue growth, and major investments—can become obscured. These inefficiencies can obscure critical insights needed for effective board meetings. This inefficiency carries a tangible cost, including delayed strategic decisions, missed opportunities to highlight key performance drivers, and the frustration of leadership spending valuable time on administrative tasks rather than strategic analysis. AI is transforming the CFO’s role by automating routine tasks such as data analysis, report generation, and financial forecasting, thereby freeing up time for higher-value activities.

TL;DR

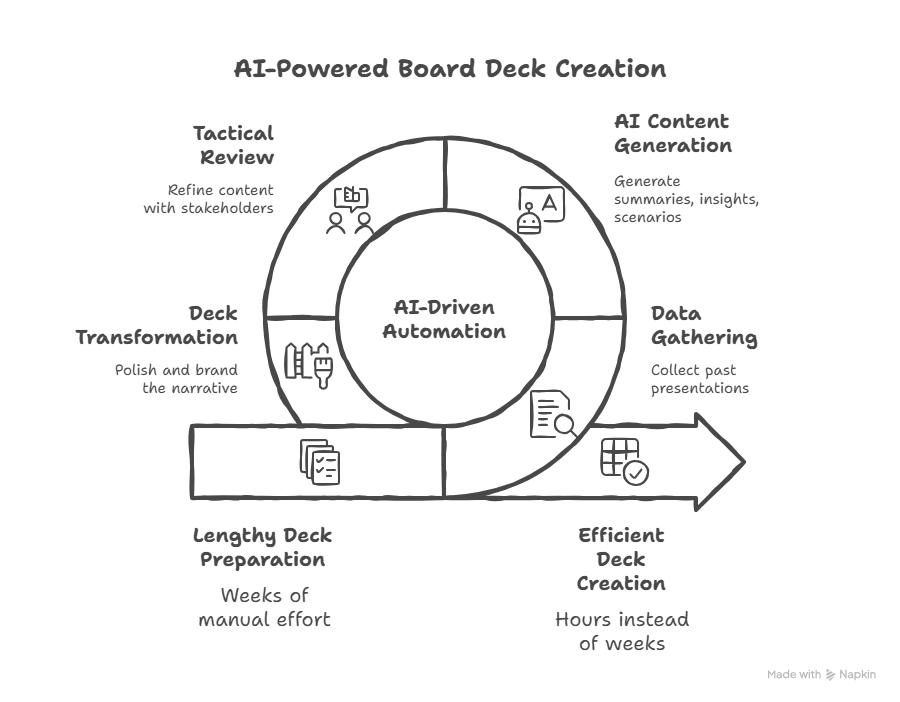

Traditional board deck preparation takes weeks and 40+ hours, often producing dense slides with little strategic clarity. AI tools can now enable CFOs to build board-ready decks in as little as four hours:

- Phase 0 (2 hr, one-time setup): Gather previous presentations and materials for identifying critical storylines from recent discussions and preferred presentation slides that are already high-grade. Train the AI with these materials in a secure project.

- Phase 1 (1 hr): AI generates executive summaries, risk insights, and scenario options, creating a clear strategic narrative.

- Phase 2 (2 hrs): Tactical review of content produced by AI with iteration as needed to refine the materials in a systematic improvement process. Share the outputs with key stakeholders for feedback and continue the refinement process.

- Phase 3 (1 hr): AI-powered platforms transform that narrative into polished, branded decks with professional visuals for final approval and human editing.

The result: better more impactful slides, stronger storytelling, and discussions that focus on strategy.

CFOs adopting this approach report faster prep cycles, higher board engagement, and more effective decision-making.

What is an AI-Powered Finance Function?

An AI-powered finance function represents a fundamental shift in how organizations manage and leverage financial data. By integrating advanced AI tools into daily operations, finance leaders can automate time-consuming tasks such as data entry, reconciliation, and routine reporting. This automation not only increases operational efficiency but also allows the finance team to redirect their efforts toward activities that drive long-term value.

With AI handling the technical aspects of data processing, finance professionals gain more time to focus on strategic insight, financial planning, and risk management. AI-powered analytics can quickly surface key metrics, identify emerging trends, and provide scenario planning capabilities that support more informed, agile decision-making. This empowers finance leaders to deliver strategic guidance to the board and executive team, ensuring that financial operations are closely aligned with business objectives.

Ultimately, an AI-powered finance function transforms the finance team from a back-office support role into a proactive business partner. By leveraging AI tools for everything from cash flow forecasting to risk assessment, organizations can enhance their financial discipline, improve forecasting accuracy, and respond more effectively to market dynamics. This modern approach positions the finance function as a critical driver of sustainable growth and competitive advantage.

The AI-Augmented Workflow

Emerging AI technologies now offer a transformative approach, condensing a weeks-long process into a focused, four-hour workflow. By leveraging AI tools for narrative generation and platforms like Gamma and Canva for visual design, CFOs can elevate their presentations from routine reports to powerful strategic tools. Finance, as a core business function, is experiencing significant transformation through AI integration, resulting in improved efficiency and enhanced decision-making—while also enabling finance teams to stay ahead of industry trends. This workflow supports operational excellence by streamlining business processes and system implementation, and leverages operational expertise to drive strategic improvements and value creation.

The following framework outlines this efficient, four-phase methodology:

Phase 0: Foundation and AI Training (Approx. 2 Hours, One-Time Setup)

This critical preparatory phase establishes the foundation for AI-assisted board deck creation by training the system with institutional knowledge. Note: This phase is typically a one-time investment. Once completed, future board decks can skip directly to Phase 1, enabling the true four-hour workflow.

- Historical Material Gathering: Collect previous board presentations, quarterly reviews, and strategic planning materials from the past 2-4 quarters. Identify presentations that received particularly positive board feedback or generated productive strategic discussions.

- Storyline Identification: Review past board minutes and feedback to understand recurring themes, questions, and areas of focus. Document the critical narratives that have resonated with board members, such as market positioning, operational efficiency initiatives, or risk mitigation strategies.

- Secure Project Configuration: Upload these high-grade materials into a secure AI project workspace (using platforms with enterprise-grade security like Claude Projects or ChatGPT Teams). Ensure proper data governance protocols are followed to protect sensitive financial information.

- AI Context Setting: Provide the AI with explicit instructions about company-specific terminology, preferred presentation formats, board composition and priorities, and any regulatory or industry-specific reporting requirements. Ensure the AI is trained on your company’s business model and recent financial data, such as the past week’s AR, to improve the relevance and accuracy of its outputs.

Result: A well-trained AI system that understands your organization’s communication style, strategic priorities, and board expectations, creating a foundation for more relevant and contextually appropriate output. Once established, this foundation can be maintained with periodic updates rather than complete rebuilds, making subsequent board decks truly achievable in four hours or less.

Phase 1: Strategic Analysis and Narrative Development (Approx. 1 Hour)

This phase focuses on converting raw financial data into a coherent executive narrative.

- AI-Assisted Insight Generation: By inputting key financial tables and KPIs—such as customer acquisition costs, monthly recurring revenue, and leading indicators—into advanced language models like ChatGPT or Claude, CFOs can rapidly generate executive summaries, identify potential risks, and explore various narrative angles tailored to board priorities (e.g., growth acceleration, margin improvement, or liquidity management).

- Drafting the Executive Summary: Instead of building slides sequentially, the process begins with a concise, one-to-two-page overview. AI can draft this summary to immediately highlight the most critical takeaways for executive decision-making.

- Scenario Framing: AI can efficiently outline alternative scenarios, allowing the CFO to present strategic options clearly, whether concerning market expansion, risk mitigation, or capital allocation. This includes analyzing cash flow management and customer behavior patterns to inform strategic options.

Result: A clearly defined strategic storyline and a set of focused talking points, ensuring alignment with the board’s informational needs. Crafting a compelling strategic story that connects financial results to broader business objectives helps engage board members more effectively.

Phase 2: Iterative Refinement and Stakeholder Review (Approx. 2 Hours)

This phase ensures the AI-generated content meets quality standards and aligns with stakeholder expectations through systematic improvement.

- Tactical Content Review: Conduct a thorough evaluation of AI-generated narratives, checking for accuracy, relevance, and strategic alignment. Verify that all financial figures, including operational expenses, are correct and that the narrative addresses known board concerns, ensuring operational expenses are accurately modeled and relevant to the business context.

- Systematic Iteration Process: Work through the content methodically, refining language, strengthening key messages, and ensuring logical flow. Use the AI as a collaborative partner, requesting alternative framings or additional analysis where needed.

- Stakeholder Feedback Loop: Share draft narratives and key insights with department heads, the CEO, or other board presentation contributors. Incorporate their perspectives and domain expertise to enrich the strategic narrative.

- Quality Assurance: Validate that the content strikes the appropriate balance between detail and accessibility, ensuring complex financial concepts are explained clearly for board members with varying levels of financial expertise.

Result: A refined, stakeholder-validated narrative that synthesizes multiple perspectives and is ready for visual transformation into presentation format.

Phase 3: Visual Synthesis and Presentation Assembly (Approx. 1 Hour)

With the narrative established and refined, AI-driven design tools facilitate the rapid creation of a professional deck.

- Dynamic Deck Generation (e.g., Gamma): Platforms like Gamma use natural language input to generate logically flowing slide decks. The CFO provides the outlined narrative, and the tool structures it into a visually coherent presentation, eliminating manual formatting.

- Professional Data Visualization (e.g., Canva): Canva’s AI design tools can transform data sets into polished charts and infographics. These tools can be configured to adhere to company brand guidelines automatically, ensuring a consistent and professional appearance. A solid grasp of the technical aspects of data visualization and financial modeling is essential to maximize the value of these AI-driven tools.

- AI-Powered Slide Creation: Both platforms allow for the generation of entire slides from text prompts (e.g., “Create a slide comparing Q3 actuals to forecast, highlighting variance drivers”).

- Final Human Review and Editing: Conduct a final review to ensure visual consistency, verify that charts accurately represent the data, and make any necessary adjustments to layout or emphasis.

Result: A board-ready presentation that is visually compelling, narratively consistent, and easily adaptable for future updates.

Managing AI Hallucinations in Financial Reporting

One of the most critical risks when using AI for financial presentations is the phenomenon of “hallucinations”—instances where AI generates plausible-sounding but factually incorrect or fabricated information. In the context of board reporting, where accuracy and credibility are paramount, even a single error can undermine trust and lead to flawed strategic decisions. Finance leaders must remain vigilant and implement rigorous safeguards to prevent AI-generated inaccuracies from reaching the boardroom.

Understanding AI Hallucinations in Finance

AI hallucinations occur when language models generate content that appears authoritative but lacks factual basis. In financial contexts, this might manifest as:

- Fabricated financial figures or metrics that seem reasonable but don’t match actual data

- Invented trend explanations that sound logical but misrepresent the true drivers of performance

- Fictional industry benchmarks or competitive comparisons created to fill gaps in the AI’s training data

- Misattributed sources or citations that don’t actually exist or don’t support the stated claim

- Spurious correlations presented as causal relationships without proper analytical foundation

Prevention Strategies

1. Never Input Raw Data Without Context Always provide AI tools with clear, structured data accompanied by explicit labels and context. Ambiguous inputs increase the likelihood of misinterpretation and hallucination.

2. Implement Multi-Layer Verification Establish a systematic verification process where:

- Every AI-generated financial figure is cross-referenced against source systems

- All trend analyses are validated against actual historical data

- Scenario projections are tested against established financial models

- Industry comparisons are verified through authoritative sources

3. Use AI as a Draft Generator, Not a Final Authority Treat AI output as a sophisticated first draft that requires expert review. The CFO and finance team should view their role as editors and validators, not passive recipients of AI-generated content.

4. Maintain Source Data Traceability Keep clear documentation linking every statement in the presentation back to its underlying data source. This enables rapid verification and builds confidence in the presentation’s accuracy.

5. Establish Clear Boundaries for AI Use Define specific areas where AI assistance is appropriate (narrative framing, slide design, scenario exploration) and areas where human expertise is non-negotiable (final data validation, strategic recommendations, risk assessment).

Detection and Correction Protocols

Red Flags for Potential Hallucinations:

- Figures that seem unusually round or convenient

- Explanations that feel generic rather than company-specific

- Claims lacking clear attribution to source data

- Narratives that contradict known business realities

- Overly confident predictions without appropriate caveats

Correction Workflow:

- Immediate flagging: Mark any suspicious content for verification

- Source validation: Trace the claim back to original data

- Expert consultation: Engage domain experts to validate technical claims

- Documentation: Record the error and correction to improve future prompts

- Template refinement: Update AI instructions to prevent similar issues

Building a Culture of Healthy Skepticism

Successful AI adoption in finance requires fostering a team culture that combines enthusiasm for innovation with rigorous analytical discipline. Team members should be encouraged to:

- Question AI outputs that seem too perfect or too convenient

- Request source documentation for all material claims

- Raise concerns about potential inaccuracies without fear of slowing the process

- Celebrate the discovery of errors before they reach stakeholders

- Continuously refine prompts and processes based on lessons learned

By maintaining vigilance against hallucinations while leveraging AI’s efficiency gains, finance teams can achieve the best of both worlds: dramatically faster board deck preparation without compromising the accuracy and credibility that stakeholders demand.

Strategic Applications for Finance Leadership

This streamlined workflow enhances reporting across key CFO responsibilities:

- Quarterly Performance Reviews: Transforms KPIs into a strategic narrative on performance drivers, challenges, and forward-looking initiatives.

- Budget and Forecast Presentations: Converts complex models into accessible charts and scenarios that clearly communicate strategic trade-offs.

- Risk and Compliance Reporting: Reframes regulatory updates into board-ready insights, focusing on exposure, mitigation strategies, and required decisions. AI also streamlines audit preparation by improving data accuracy and facilitating compliance monitoring, helping organizations proactively address regulatory risks.

- M&A and Capital Allocation Proposals: Summarizes intricate deal models into concise, visually supported overviews to accelerate board understanding and confidence.

AI-driven operational improvements in financial processes can lead to measurable cost savings by increasing efficiency and reducing resource requirements. Ongoing support from financial partners or fractional CFOs is essential to sustain these benefits and ensure continuous strategic value creation.

Risk Management Strategies in AI-Augmented Board Reporting

As finance leaders embrace AI-augmented board reporting, robust risk management becomes essential to safeguard the integrity and reliability of financial data. To ensure that board members can trust the insights presented, finance teams should implement comprehensive data validation protocols that catch errors or inconsistencies before they reach the boardroom. Regularly updating AI models to reflect evolving market dynamics is also critical, as outdated algorithms can lead to inaccurate financial forecasting and misinformed strategic decisions.

Establishing clear guidelines for the use of AI in financial forecasting helps maintain consistency and transparency in board reporting. Finance teams should also conduct thorough sensitivity analyses, evaluating how different scenarios could impact financial performance. This proactive approach enables finance leaders to anticipate potential risks and present well-informed contingency plans, reinforcing the board’s confidence in the finance function’s ability to manage uncertainty. By integrating these risk management strategies, organizations can fully leverage AI’s benefits while upholding the highest standards of financial reporting.

A Comparative View: Traditional vs. AI-Augmented Output

- Traditional Deck: Often 40+ slides of dense data tables; inconsistent formatting; board discussion centers on clarifying figures rather than strategic debate.

- AI-Augmented Deck: Typically 20+ slides built around a central narrative; clear visuals and consistent design; board dialogue focuses on strategic decisions, approvals, and risk assessment.

CFOs adopting this approach report higher levels of board engagement, faster decision-making, and a significant reduction in follow-up data requests. The AI-augmented process enhances board meeting effectiveness by centering discussions on key insights and reinforcing operational discipline, ensuring that financial narratives drive informed, strategic outcomes.

Integration Costs and Considerations

Integrating AI tools into financial operations requires careful planning and a clear understanding of both immediate and long-term costs. Beyond the initial investment in AI solutions, finance teams must account for ongoing maintenance, periodic updates, and the training required to ensure staff can effectively use new technologies. Compatibility with existing financial systems is another key consideration, as seamless integration is vital for maintaining efficient financial planning and reporting processes.

Finance leaders should conduct a thorough cost-benefit analysis to determine whether the adoption of AI tools aligns with the organization’s strategic priorities and supports long term value creation. Scalability is also crucial—AI solutions should be able to grow with the business and adapt to changing operational needs. By evaluating these factors, finance teams can maximize the return on investment, minimize disruption, and ensure that AI integration strengthens the overall financial operations of the organization.

AI Prompts and Automation: Accelerating Board Deck Creation

AI prompts and automation are revolutionizing the way finance teams create board decks, enabling faster, more insightful presentations. By automating the collection and analysis of financial data, AI tools help identify key metrics and generate executive-level narratives with minimal manual effort. This allows finance teams to focus on strategic decision making and financial storytelling, rather than getting bogged down in routine tasks.

Effective use of AI prompts can streamline processes such as variance analysis, cash flow forecasting, and financial reporting, ensuring that board members receive timely, accurate, and actionable insights. Additionally, AI tools can seamlessly integrate operational metrics and industry benchmarks into board presentations, providing a comprehensive view of financial performance and competitive positioning. The result is a more efficient workflow that empowers finance teams to deliver high-impact board reporting with greater speed and clarity.

A Phased Implementation Plan

A structured 90-day rollout is recommended for successful adoption:

- Weeks 1-2: Tool Evaluation and Team Training: Select the appropriate AI stack and conduct training sessions for the finance team on effective prompting and workflows.

- Weeks 3-8: Pilot Program: Apply the new workflow to internal management or investor reports, with the option to extend the pilot to other business functions and portfolio companies to maximize impact. Use this period to gather feedback, refine templates, and standardize branding.

- Weeks 9-12: Full Integration: Implement the four-hour workflow for the quarterly board deck. Track key metrics such as preparation time, board feedback, and the clarity of resulting action items.

This phased approach enables organizations to build strategic foresight and adaptability into their financial reporting processes.

Common Challenges and Solutions in AI-Driven Financial Presentations

While AI-driven financial presentations offer significant advantages, finance teams may encounter challenges such as ensuring data accuracy, avoiding overly optimistic projections, and translating complex financial information for non-financial board members. To address these issues, finance leaders should implement rigorous data validation protocols and use sensitivity analyses to test the robustness of financial models and assumptions.

Clear and concise storytelling is essential for conveying strategic insights and facilitating informed decision-making. By leveraging AI tools to build board slides that integrate both financial and operational metrics, finance teams can present a holistic view of business performance. This approach not only supports sustainable growth but also helps board members make strategic decisions with confidence. Proactive communication and ongoing refinement of AI-driven processes ensure that presentations remain accurate, relevant, and impactful.

Measuring Impact

Success can be quantified through:

- Efficiency: Target an 80% reduction in deck preparation time—from 40+ hours to just 4 hours.

- Engagement: Measure a shift in board questioning from data clarification to strategic inquiry.

- Effectiveness: Monitor the acceleration of key decisions and approvals, track progress toward growth targets, and assess enhancement of shareholder value.

Future of Finance and AI-Driven Board Presentations

The future of finance is being shaped by the rapid adoption of AI-driven board presentations, as finance leaders seek to enhance financial discipline, operational efficiency, and strategic guidance. As AI tools continue to advance, finance teams will benefit from innovations in predictive analytics, automated financial modeling, and personalized board reporting—enabling more precise forecasting and deeper strategic insight.

To stay ahead, finance professionals must develop expertise in strategic thinking, financial storytelling, and the effective use of AI tools for board reporting. By embracing these technologies, organizations can unlock new opportunities for business growth, improve the quality of decision-making, and build a foundation for long-term success. The integration of AI into the finance function is not just a technological upgrade—it represents a fundamental shift towards a more agile, data-driven, and strategically focused finance organization.

Conclusion

The responsibility of communicating with the board is among a CFO’s most critical functions. An effective presentation builds credibility, fosters trust, and accelerates corporate strategy. The integration of AI into this process is not about reducing quality, but about reallocating the CFO’s most scarce resource—time—from production to strategic analysis. By leveraging these tools, finance leaders can ensure their expertise is focused where it delivers the greatest value: shaping strategy and guiding the organization’s future.

Frequently Asked Questions (FAQs)

1. How does AI reduce the time required to prepare quarterly board presentations for CFOs?

AI streamlines the board deck preparation by automating data analysis, narrative generation, and slide design. Tools like ChatGPT quickly produce executive summaries and scenario analyses, while platforms such as Gamma and Canva generate visually compelling slides. This integration condenses a process that traditionally takes weeks and over 40 hours into a focused four-hour workflow.

2. What are the key benefits of using AI-augmented workflows for financial presentations?

AI-augmented workflows enhance the clarity and strategic focus of financial presentations. They enable CFOs to shift from manual data compilation to delivering insightful narratives tied to business priorities. The result is higher board engagement, faster decision-making, reduced follow-up requests, and presentations that emphasize strategic guidance over raw data.

3. How can finance teams successfully adopt AI tools for board reporting?

Successful adoption involves a phased approach: evaluating and training on AI tools, piloting the workflow on internal reports, and then fully integrating the process for board presentations. This structured rollout helps teams refine templates, standardize branding, and track improvements in efficiency, engagement, and decision effectiveness.

This article was originally published on cfoproanalytics.com titled “4 Hours to a Board Deck: How CFOs Are Using AI to Transform Financial Presentations“

At CFO Pro+Analytics, we help startups turn financial complexity into clarity. Whether you need investor-ready financial models, strategic budgeting, or ongoing CFO support, we provide scalable, on-demand financial leadership tailored to your growth stage.

Schedule a conversation to discover how our Fractional CFO service can help your business thrive in New York’s fast-paced market.

Leave a Reply