I recently created a series of financial calculators for businesses on my firm’s website. Shortly after I added the rule of 78s calculator, a useful concept I have used for years, I met a SaaS banker who had never heard of the rule of 78s. I learned the rule from some of the founding executives that ran McCaw Cellular, which became AT&T wireless. They often used it to discuss the revenue risks of shortfalls in expected new MRR from new wireless subscribers. It applies to all recurring revenue businesses and has many other uses. The general application is to understand what will happen to your annual recurring revenue and calendarized 1-year recurring revenue when you overachieve or underperform in the early months of your forecast.

Why is it called the rule of 78s? The 78 comes from that fact that Month 1 MRR is counted 12 times, Month 2 MRR is counted 11 times and so forth and Month 12 MRR is counted 1 time in your calendarized 1-year projection. When you add this up (12+11+10+9…+3+2+1) you get 78. In a flat MRR projection, you can just take the MRR and multiply by 78 and it will give you the annual revenue forecast.

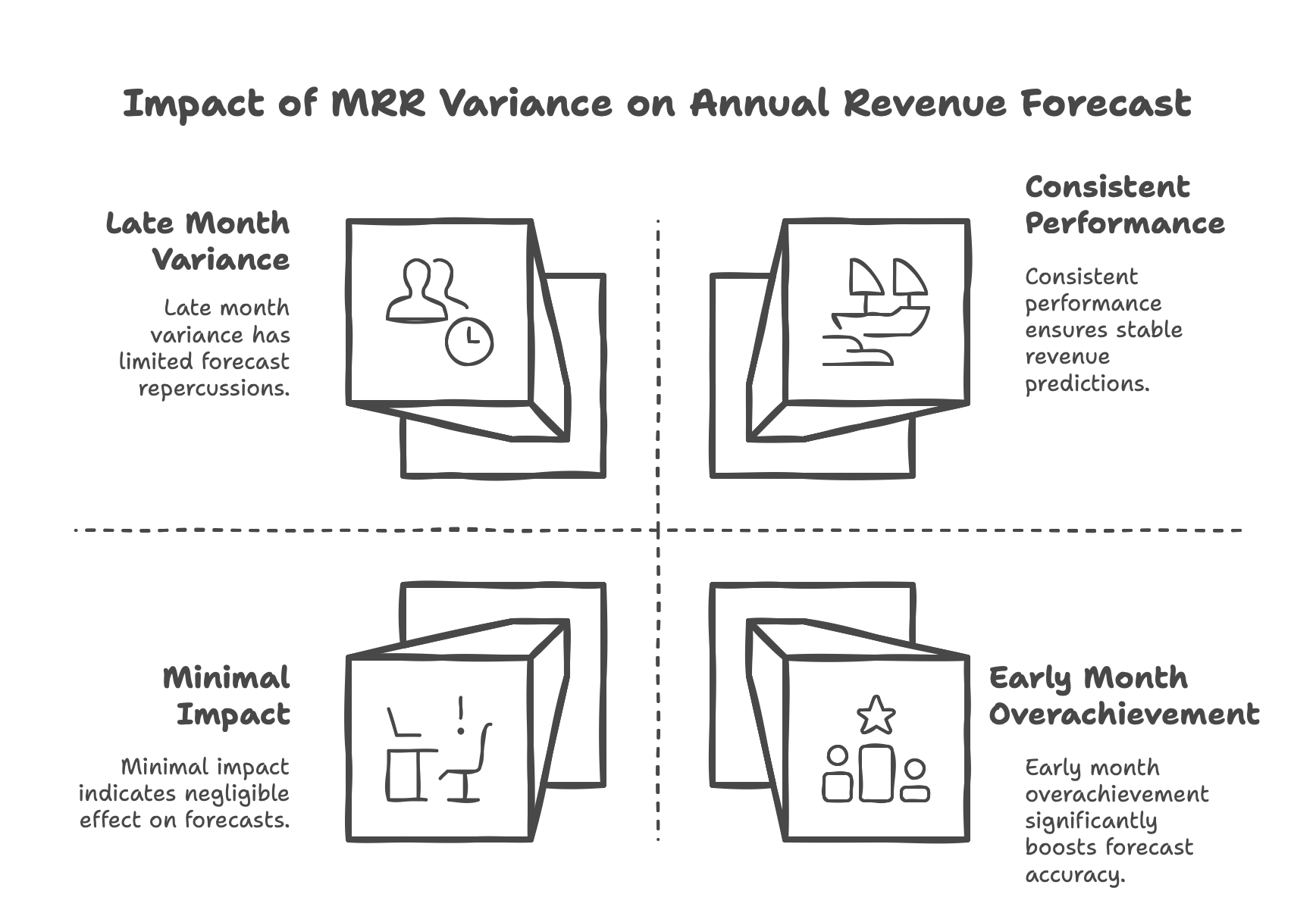

From a practical forecasting standpoint, the critical insight is that your 12-month calendarized forecast will be impacted disproportionately by the variance of MRR in the initial months. When you miss those early month forecasts, it is very, very difficult to make it up over the rest of the year because month 1 MRR is worth 12x what month 12 MRR is worth. The impact of this will live with the forecast in ensuing years too.

What is Recurring Revenue?

Recurring revenue is the lifeblood of many modern businesses, particularly those operating under subscription models. It represents the portion of a company’s revenue that is predictable, stable, and expected to continue at regular intervals. This type of revenue is highly valued because it provides a reliable stream of income that can be counted on to support ongoing operations and growth initiatives.

For businesses, recurring revenue can come from various sources, such as subscription-based services, long-term contracts, and auto-renewing subscriptions. Investors and analysts also pay close attention to recurring revenue because it offers a clearer picture of a company’s financial health and future prospects. Unlike one-time sales, recurring revenue provides a steady flow of income that can be more easily forecasted and managed.

In essence, recurring revenue is a key metric for any business looking to build a sustainable and scalable model. It allows companies to plan more effectively, allocate resources more efficiently, and ultimately drive long-term growth.

Annual Recurring Revenue (ARR)

Annual Recurring Revenue (ARR) is a critical metric for

with subscription models, as it measures the predictable revenue generated annually from term subscriptions. ARR provides a clear view of the revenue a business can expect to receive each year, making it an invaluable tool for financial planning and forecasting.

To calculate ARR, you take the total value of a subscription and divide it by the number of years in the subscription period. For instance, if a customer signs a two-year subscription for $12,000, the ARR would be $6,000 per year. This metric normalizes the value of recurring revenue over a single calendar year, offering a straightforward way to assess the financial health and growth potential of a business.

ARR is particularly useful for SaaS companies and other subscription-based businesses because it provides a stable and predictable revenue stream that can be relied upon year after year. By focusing on ARR, businesses can better understand their revenue dynamics, set more accurate financial targets, and make informed strategic decisions.

Monthly Recurring Revenue (MRR)

Monthly Recurring Revenue (MRR) is another essential metric for subscription-based businesses, particularly SaaS companies. MRR measures the predictable revenue generated on a monthly basis, providing a more granular view of a company’s financial performance.

MRR includes all recurring revenue components, such as upgrades, coupons, and discounts, but typically excludes one-time and variable fees. This metric is crucial for tracking performance across different subscription terms and understanding the monthly revenue flow. Unlike ARR, MRR is not defined by Financial Accounting Standards Board (FASB) or Generally Accepted Accounting Principles (GAAP), which means there is some flexibility in how it can be calculated.

For SaaS companies, MRR is a vital indicator of business health and growth. It helps businesses monitor their monthly revenue trends, identify potential issues early, and make data-driven decisions to optimize their subscription models. By focusing on MRR, companies can ensure they maintain a steady and predictable revenue stream, which is essential for long-term success.

The Rule of 78s: A Key Concept in Recurring Revenue Forecasting

The Rule of 78s is a pivotal concept in the realm of recurring revenue forecasting. Originally used to calculate the interest paid on a simple interest loan, this rule has found significant application in forecasting recurring revenue due to its ability to account for the predictable and recurring nature of such revenue streams.

In the context of recurring revenue, the Rule of 78s helps businesses understand the disproportionate impact of early-month performance on annual revenue. By recognizing that revenue generated in the initial months of a year has a more substantial cumulative effect, businesses can better strategize their sales and marketing efforts to maximize early gains.

This method is particularly useful for subscription-based models, where the timing of revenue generation can significantly influence annual financial outcomes. By applying the Rule of 78s, businesses can create more accurate and reliable revenue forecasts, ensuring they are better prepared to meet their financial goals and manage growth effectively.

Practical Applications for SaaS and Subscription Businesses with Recurring Revenue

The implications of the Rule of 78s are profound for any subscription-based business. Having worked with numerous SaaS companies and helped scale a business from $38M to $198M in revenue, I’ve seen firsthand how this mathematical reality shapes strategic decision-making. Accurate forecast revenue using metrics like MRR and ARR is crucial as it serves as a baseline for projecting future revenues.

For example, if you’re forecasting $10,000 in new MRR for each month of the year, your annual revenue contribution from these new customers would be $780,000 (10,000 × 78). However, if you miss your January target by $2,000 (achieving only $8,000 in new MRR), that single month’s shortfall reduces your annual revenue by $24,000 ($2,000 × 12). To make up for this throughout the year, you would need to exceed your monthly targets by approximately $240 each month for the remaining 11 months – a much more challenging task than hitting your original target in January. The subscription model benefits significantly from accurate revenue forecasting, ensuring better alignment between pricing and value propositions.

Strategic Planning Implications

Understanding the Rule of 78s fundamentally changes how you should approach strategic planning:

- Front-Load Your Efforts: Since early months have a disproportionate impact on annual revenue, successful subscription businesses invest heavily in sales and marketing at the beginning of each fiscal year or planning period. The ROI on customer acquisition is significantly higher in January than in December.

- Conservative Early Forecasting: When building your financial models, it’s prudent to be more conservative with early month projections. Overoptimistic forecasting in Q1 can create unrecoverable revenue gaps for the entire year. This conservative approach also helps in estimating future GAAP revenue, as ARR and MRR provide insights into growth and revenue predictability.

- Cash Flow Planning: The Rule of 78s has important cash flow implications. If you’re investing heavily in growth, understanding this rule helps you better predict when new revenue will meaningfully impact your cash position.

Visualizing the Impact of Annual Recurring Revenue

To truly appreciate the Rule of 78s, consider a visual representation. Imagine two scenarios:

Scenario A: You consistently hit your target of $10,000 new MRR each month. Scenario B: You miss January by $3,000 but exceed each remaining month by $300.

The Rule of 78s helps in understanding predictable and recurring revenue, which is crucial for assessing annual financial outcomes. This predictable and recurring revenue is a key metric in understanding Annual Recurring Revenue (ARR), representing the income expected on an annual basis from customers in subscription-based businesses.

While both scenarios show the same total MRR added for the year ($120,000), Scenario A would generate $780,000 in annual revenue, while Scenario B would only generate $744,000 – a $36,000 difference despite adding the same total MRR!

Calculating and Analyzing Recurring Revenue

Calculating and analyzing recurring revenue is a fundamental practice for businesses that rely on subscription models. To calculate recurring revenue, you multiply the number of customers by the average revenue per user (ARPU). This straightforward calculation provides a snapshot of the revenue generated from recurring sources.

However, a comprehensive analysis of recurring revenue requires considering various factors, such as contract start and end dates, renewal and non-renewal rates, gaps in contracts, and early renewal upgrades. By examining these elements, businesses can identify trends, forecast future revenue, and make informed decisions about pricing, customer acquisition, and retention strategies.

Analyzing recurring revenue also helps businesses understand their revenue growth patterns and identify potential areas for improvement. By leveraging this analysis, companies can optimize their subscription models, enhance customer satisfaction, and drive sustainable revenue growth. In an increasingly competitive market, a deep understanding of recurring revenue dynamics is essential for long-term success.

Application Beyond New Customer Acquisition for Existing Customers

The Rule of 78s isn’t limited to new customer acquisition. It applies to any recurring revenue component:

- Expansion Revenue: Upselling existing customers early in the year has a significantly higher annual impact than the same upsell in later months, affecting the recurring revenue generated over the year.

- Churn Management: Customer retention efforts should be particularly aggressive in early months. Losing a $5,000/month customer in January is equivalent to losing more than $5,000 × 12 = $60,000 in annual revenue.

- Price Increases: Implementing price increases at the beginning of your fiscal year maximizes the annual revenue impact.

Traditional enterprise resource planning systems might struggle to track non-GAAP metrics like Annual Recurring Revenue (ARR), often leading businesses to rely on spreadsheets that lack real-time accuracy.

Common Misconceptions

Despite its utility, several misconceptions about the Rule of 78s persist:

- It’s Not Just About Sales: While sales teams often focus on the rule for commission structures, it’s truly a planning tool for the entire organization. It helps in understanding the broader implications of recurring revenues, which create predictable and stable income streams, viewed favorably by investors for their reliability and potential to lower operational risks.

- It Doesn’t Replace Traditional Forecasting: The Rule of 78s complements, rather than replaces, traditional forecasting methods. It helps explain why certain variances have outsized impacts.

- It’s Not About Equal Distribution: The rule works regardless of whether you forecast equal MRR additions each month. The weighting principle applies to any recurring revenue pattern.

Implementing the Rule of 78s in Your Business

Having implemented sophisticated forecasting models that maintained 98% accuracy, I recommend these steps to leverage the Rule of 78s effectively:

- Create a Weighted Forecast Model: Build a model that explicitly shows the weighted impact of each month’s projected MRR on annual revenue. Understanding how customers pay over the duration of their contracts can help in creating a more accurate weighted forecast model. The weighted model is not specifically weighting revenues but it reflects the impact of earlier revenues naturally in the calendar. This is one reason I prefer monthly models.

- Develop Early Warning Systems: Establish KPIs that quickly alert you to potential misses in early months, allowing for rapid course correction.

- Align Incentives Accordingly: Consider weighting sales compensation to reflect the true revenue impact of early-year performance.

- Communicate the Principle: Ensure all stakeholders understand why early performance is so critical to annual results.

Conclusion

The Rule of 78s represents one of the most powerful yet underappreciated principles in subscription business forecasting. By understanding and applying this concept, you can make more informed decisions about resource allocation, set more realistic forecasts, and better understand the true impact of performance variances.

For businesses with recurring revenue models—whether SaaS, membership services, or subscription products—mastering this principle is not merely an academic exercise but a practical necessity for accurate financial planning and successful growth management.

Would you like to learn more about how the Rule of 78s might apply to your specific business model? Feel free to explore our financial calculators or reach out for a consultation on implementing sophisticated forecasting models for your subscription business.

Frequently Asked Questions about the Rule of 78s

Q1. How do you apply the Rule of 78?

To apply the Rule of 78, multiply the amount of new recurring revenue you expect each month by 78 to estimate the total annual revenue. Conversely, divide your target annual revenue by 78 to determine how much new recurring revenue you need each month to meet your goal.

Q2. What are the assumptions of the Rule of 78?

The Rule of 78 assumes that one new customer is acquired each month, each customer pays the same monthly fee and the customer remains active for the rest of the year.

Q3. How does the Rule of 78 help in forecasting?

The Rule of 78 helps businesses forecast annual revenue by accounting for the compounding effect of recurring payments. It helps set sales quotas and evaluate financial stability.