This year, I launched a Fractional CFO Services business. As part of my effort to streamline the financial reporting at my clients, I started using a software platform called Bunker, an innovative software company that provides great software for a Fractional CFO driving FP&A reporting, among other things. Bunker is specifically designed for fractional CFOs and supports a wide range of fractional CFO services, including financial management, financial planning, and strategic financial planning.

TL;DR

When evaluating financial reporting platforms as a fractional CFO, Bunker emerges as the top choice over competitors like Reach Reporting. Bunker’s transaction-level visibility and collaboration features go beyond basic trial balance reporting, offering comprehensive financial dashboards, expense control, and analytics that help identify cost-saving opportunities. For fractional CFOs, standardizing on a common tech stack across clients delivers more value with less complexity, making these platforms game-changers for financial reporting and business operations.

Evaluation

In order to settle on Bunker, I demoed a number of other platforms. There are some good products out there. Many CFOs in small to medium-sized businesses rely on these software tools to streamline operations and support CFOs in their daily work. Ultimately, I started using Bunker because it offers accountants and FP&A professionals a common collaboration point around variances and transactional detail. (Bunker does many other things – the cash flow and receivables analytics are excellent – for example.)

For the accounting geeks, I was surprised to see how many of the other solutions in the market stop at the trial balance, which does not help reporting and quality checks on booking entries because it’s too high level with no visibility into the underlying transactions that are causing you to ask questions.

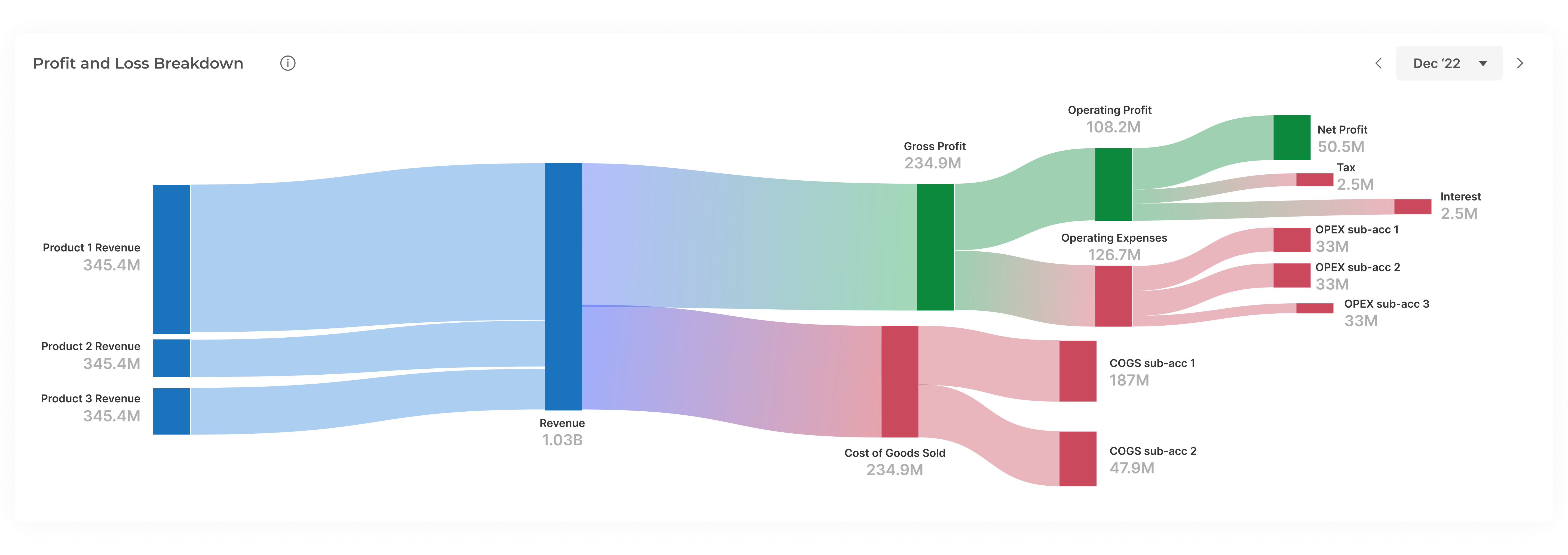

Overall, Bunker offers a financial analytics platform that focuses on turning financial data into cost-saving decisions. It is designed to provide deep visibility into a company’s financials through an intuitive dashboard and monthly reports. The platform emphasizes transaction-level visibility, which can lead to significant cost savings by identifying overlooked expenses. Bunker’s key features include:

- Complete Financial Visibility: Intuitive financial dashboards and monthly reports offer timely access to critical financial data, allowing users to identify potential risks and leverage cost-cutting opportunities.

- Absolute Expense Control: The platform’s intelligent expense control system uncovers hidden leakages, anomalies, and trends.

- Optimized Accounting Hygiene: BunkerTech.io ensures meticulous accuracy in financial records, aiding in swift corrections and elevating accounting rigour1.

- Expense Management: Bunker streamlines expense management by automating expense tracking, reducing manual data entry, and helping finance teams save time while maintaining accurate records.

The platform is touted as an automated financial analyst, analyzing thousands of rows in the General Ledger for faster and sharper results. It is particularly beneficial for early to mid-stage businesses, as it drives confidence for fundraising and financial due diligence. BunkerTech.io is easy to use, and requires no training or complex implementation.

The platform features include:

- P&L Dashboard: Gain instant insights into financial metrics. Sort numbers from largest to smallest, compare month-on-month variance, spot potential issues early and access waterfall charts to explain your biggest swings.

- Vendor Dashboard: Track vendor spends, count and spot negotiation opportunities

- AR Dashboard: Streamline collections to help cash flow and identify problem customers

- Cashflow dashboard: Manage cashflow and itemize your cashflow category movements.

Bunker’s dashboards also include robust reporting tools that provide valuable insights for strategic financial planning and financial management, helping fractional CFOs and finance teams make informed decisions.

Another platform that I reviewed is Reach Reporting. Reach Reporting has been around for a longer period of time than Bunker and has a great roster of clients. Reach provides a suite of tools for self-service reporting and planning. It integrates with various accounting software like QuickBooks and Xero, and allows for the automation of financial dashboards and reports. Reach Reporting is cloud based and features a user friendly interface, making it accessible for small businesses and early stage startups. Reach Reporting’s key features include:

- Integration & Automation: Seamless integration with accounting software and datasheets, including Google Sheets, for real-time data access.

- Intuitive Customization: Users can create custom reports with Excel-like formulas, metric goals/targets, and trend lines.

- Data Storytelling: Dynamic statements, interactive metrics, and custom themes enable users to tell a story with their financial data2.

- Payroll & Financial Documents: Automate payroll processes, manage financial documents securely, and streamline compliance.

- Scenario Planning & Financial Models: Support scenario planning and the creation of financial models for comprehensive financial planning and analysis.

ReachReporting.com also offers a template library with pre-built report and dashboard templates, which are fully customizable. The platform supports budgeting and forecasting with minimal learning curves, using forecasting algorithms and custom formulas. Additionally, it provides integrated 3-way planning, connecting P&L, Balance Sheet, and Cash Flow Statement for a complete picture of a business’s trajectory2.

In summary, as a fractional CFO, it is important to have the right tools to streamline financial reporting and provide deep visibility into a company’s financials. If you can standardize on a tech stack that has commonality across customers, you can deliver more value with less complexity for your clients. These tools are a game changer for business operations, project management, and raising capital. Both Bunker and Reach Reporting offer unique features and benefits for FP&A and accounting. Bunker focuses on cost savings and expense control, while Reach Reporting offers a suite of tools for self-service reporting and planning. Ultimately, the choice of platform will depend on the specific needs and goals of the business. As a fractional CFO, it is my responsibility to evaluate and choose the best platform to help my clients make informed financial decisions and achieve their objectives, and Bunker has fit the bill in most situations I have encountered. Both platforms help companies focus on sustainable growth, cash management, and planning for their financial future.

FAQ

Q: What makes Bunker stand out from other financial reporting platforms? A: Bunker provides transaction-level visibility and serves as a collaboration point for accountants and FP&A professionals around variances and transactional details. Unlike many competitors that stop at the trial balance level, Bunker offers deep visibility into underlying transactions, plus excellent cash flow and receivables analytics.

Q: How does Reach Reporting compare to Bunker as an alternative? A: Reach Reporting has been around longer and offers strong self-service reporting and planning tools with seamless integration to accounting software like QuickBooks and Xero. While Reach focuses on customizable reporting and scenario planning, Bunker emphasizes cost savings and expense control through its intelligent analytics platform.

Q: Why is standardizing on a financial platform important for fractional CFOs? A: Standardizing on a common tech stack across clients allows you to deliver more value with less complexity. It streamlines financial reporting, reduces learning curves, and enables you to focus on strategic financial planning rather than wrestling with different platforms for each client.

As a CFO, I’ve navigated complex financial landscapes to drive growth and maximize shareholder value for companies. My expertise in analytics and data science helps streamline meeting time, provide support for CFOs, and enhance the financial health of a company’s operations.