In the dynamic landscape of SaaS business growth, SAAS Revenue KPI alignment and the resulting ability to present a clear and compelling financial narrative to potential investors is paramount. This narrative is underpinned by the strategic alignment of key revenue growth, customer retention and customer acquisition cost KPIs, which serve as indicators of the company’s financial health and potential for success. However, the complexity arises from the need to reconcile three distinct areas of revenue measurement, each with its own set of stakeholders and standards. From a Fractional CFO perspective, I encounter this issue frequently with emerging businesses. It can turn into a sprawling conversation. Here is a way to stay focused.

- Recurring Revenue Measurement At the heart of revenue KPIs for SaaS companies lies the critical analysis of contracts, a task undertaken by the finance executive, often in collaboration with the in-house lawyer. One must extract the Annual Recurring Revenue (ARR) and other pertinent revenue metrics from the legal documents that bind the company to its customers. The objective review of contracts ensures that the revenue figures are not only accurate but also legally enforceable, providing a solid foundation for financial claims.

- Billing and Service Delivery Correlation The second area of focus for companies that employ usage-based revenue models, is the correlation between service delivery and billing, a collaborative effort between the company’s revenue analyst and the client’s counterparty. This partnership aims to ensure that the billing for each period accurately reflects the services provided. It’s a critical intersection where the precision of numbers meets the client’s perception of value, and the agreement reached here directly impacts client satisfaction and the integrity of the company’s revenue claims.

- Revenue Recognition Compliance The third area involves the meticulous presentation of revenues in compliance with accounting standards, most stringently measured by the ASC 606 standard. The company accountant, together with external auditors, ensures that the revenue is reported in a manner that is both transparent and adherent to these standards. This compliance is not merely a regulatory checkbox but a significant factor in building investor trust and validating the company’s financial reporting.

For any SaaS company, Revenue Recognition and Billed Revenues require transformation to reconcile to each other. While this is not an afterthought for companies undergoing regular annual audits, for early-stage SaaS companies that have never been audited, this can become a painstaking process when the time comes to prepare this reconciliation. To add to the real-time confusion, you will experience in this process, the contracted ARR mentioned above will inevitably be added as a source of truth to the mix.

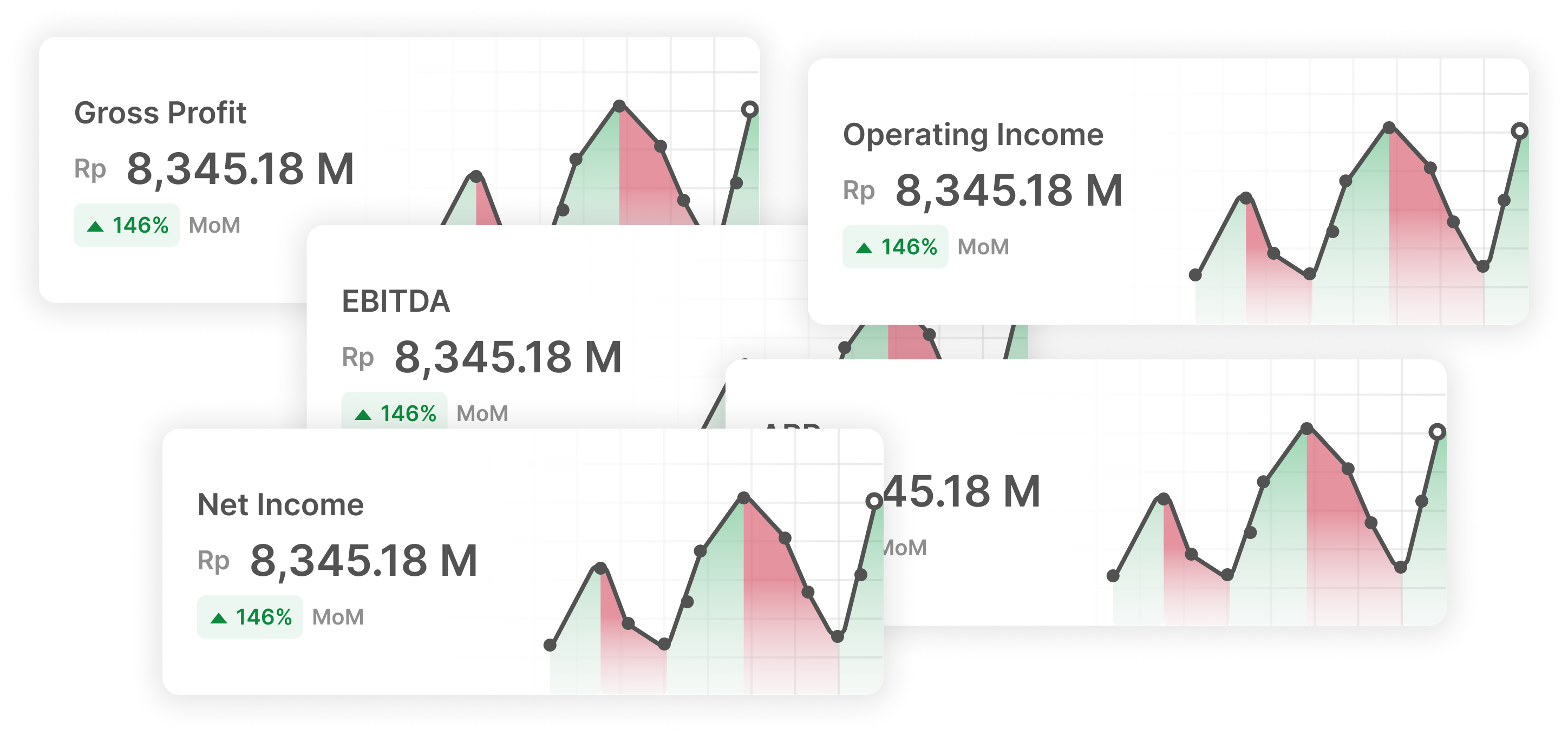

The problem can be simply shown in the pyramid below. The goal is to have the KPI truth that can drive valuation and be explained to investors with confidence and convincing data to back it up. When day-to-day business and different viewpoints come into the mix, this process can get quite messy before you arrive at the answers. By using this model to organize your discussion, you can save time and avoid tangents that misguide the objective at hand.

Common Pitfall: The Billing Data Trap

A prevalent pitfall for SaaS companies, particularly those that rely on platforms like Stripe for billing and revenue tracking, is the overemphasis on billing data for generating revenue KPIs. The abstraction of contractual revenue by such platforms can lead to a disconnect, as they do not account for the specifics of contractual obligations. This can result in a situation where the billing data suggests a different revenue level than what is contractually due, leading to an inflated and misleading ARR figure.

Imagine the scenario where a billing platform has recorded invoice amounts for services over different time periods. Unless the billing data can accurately capture the length of the underlying contractual agreements, operators will not be able to successfully determine the amount of “run rate” recurring revenue.

To circumvent this issue, it is imperative for SaaS companies to adopt a cross-functional approach that integrates contractual data beyond what billing systems track. Software tools such as Facta can capture all the crucial contract terms and provide a data system that allows financial analysts to enrich the customer data by segmenting it into groups (e.g., cohorts, customer segments, etc.) and join it with sales & marketing and other financials from the accounting system.

This synthesis and data enrichment ensures that SaaS KPIs accurately reflect the true value of contracts and the services rendered, and provides nuanced perspective on business trends, thereby providing investors with a transparent and accurate depiction of the company’s revenue trajectory. By aligning your SAAS Revenue KPIs and having a fluent bridge between the different forms of interpretation, you will achieve two critical things. First, you will have the data to back up your stated KPIs and push for more value with investors. Second, you will present and speak to these issues in a convincing way, which creates the credibility you can leverage when speaking to investors.

About me

As a CFO, I’ve navigated complex financial landscapes to drive growth and maximize shareholder value for companies. My expertise in analytics and data science enables me to deliver actionable insights that shape strategic decision-making. Connect with me on LinkedIn to discuss how my Fractional CFO expertise can support your company’s growth trajectory with CFO PRO+Analytics.

FAQS:

What is the difference between billing data and contractual data for SaaS companies?

Billing data refers to the amount and frequency of invoices generated by a billing platform for the services provided by a SaaS company. Contractual data refers to the terms and conditions of the agreements between a SaaS company and its customers, such as the length, scope, renewal, and termination clauses of the contracts.

Why is it important to integrate contractual data with billing data for SaaS KPIs?

Integrating contractual data with billing data can help SaaS companies measure their revenue more accurately and reliably, as well as identify trends and patterns in customer behavior and retention. For example, contractual data can help determine the amount of recurring revenue that is guaranteed by long-term contracts, or the potential revenue that is at risk of churn due to contract expiration or cancellation.

How can Facta help SaaS companies enrich their customer data and improve their SaaS KPIs?

Facta is a software tool that can capture and analyze all the relevant contract terms from various sources, such as PDFs, emails, or CRM systems. Facta can then provide a data system that allows financial analysts to segment and join the customer data with other data sources, such as sales & marketing and accounting. This can help SaaS companies gain insights into their customer segments, cohorts, churn rates, lifetime value, customer acquisition cost, and other key metrics.